Apple, you gained the world’s largest market capitalization since you dared suppose otherwise. So once you determined to close down zaps on Damus it got here as a shock to somebody who at all times appreciated Apple’s insurgent spirit. Eradicating zaps from the iOS retailer doesn’t cease me from zapping. It simply makes me zap in an internet browser as an alternative. Rethink what zaps can do for your corporation so that you don’t miss the forest for the bushes.

Bitcoin’s underlying expertise can’t be uninvented. It’s a revolutionary idea destined to endure so long as society requires cash and people are pushed by self-interest. Bitcoin’s invention has birthed a decentralized community poised to redefine the very material of human group, ushering in transformations beforehand unimaginable. Many individuals might by no means have imagined giving up their cellphone for an iPhone, till they noticed an iPhone. In some ways Bitcoin is comparable for cash. What Satoshi created was absolute shortage that anybody can confirm for themselves. In Satoshi and Steve we discover visionaries who reworked the unattainable into actuality, rewriting the narrative of human achievement.

Bitcoin transcends mere forex creation. If it turns into extensively adopted as a foundational layer of world finance, Bitcoin might basically remodel the function and performance of governments, just like how the web disrupted and reworked companies. As Jobs stated, “Numerous instances, individuals don’t know what they need till you present it to them.” Nice thinkers reject the established order. If Satoshi Nakamoto believed in conventional fiat edicts and “too large to fail” establishments Bitcoin wouldn’t exist.

Like money and digital funds, Bitcoin has its personal set of trade-offs. Money presents superior privateness and permits for peer-to-peer funds, however it can’t be despatched over the web. Bank cards and financial institution accounts allow handy on-line funds, however they require customers to surrender private info. Each are fiat currencies which implies they’re topic to inflation dangers. Bitcoin presents the promise of safe on-line cash transfers with out the necessity for banks or intermediaries, however it requires customers to grasp its distinctive options and take accountability for his or her funds. Should you don’t run a node, you introduce counterparty threat, the very factor Bitcoin was designed to unravel. The fragile stability between comfort and management is a private alternative. Nonetheless, I firmly imagine that the cross-disciplinary design ideas that propelled Apple to greatness might contribute considerably to resolving this stress between user-friendliness and autonomy throughout the realm of Bitcoin. Apple stands to achieve considerably by providing well-crafted Bitcoin providers and elevating the general consumer expertise.

Steve Jobs and Satoshi Nakamoto each embraced a primary ideas strategy to innovation. Nakamoto’s pioneering work led to the creation of a decentralized system that blended components of pc science, cryptography, and economics. It’s nearly poetic that such an excellent open system finds a house on Apple’s modern machines. Jobs had a singular imaginative and prescient for Apple, one the place management over each {hardware} and software program was paramount to make sure the very best high quality and consumer expertise. Whereas this strategy typically pissed off others, it undeniably performed an important function in propelling Apple to its present standing on this planet. Nevertheless, innovation is an ever-evolving panorama, and there are moments when adopting groundbreaking expertise turns into inevitable. Jobs’ dedication to regulate was unwavering, however even he acknowledged the necessity to embrace superior expertise when it emerged. Steve Wozniak, Apple’s different co-founder, has aptly labeled Bitcoin a “mathematical miracle” and I see no purpose why the opposite Steve wouldn’t have agreed. Whereas Apple stands as a formidable pressure, Bitcoin operates as an easy protocol. Apple unquestionably stands to learn from integrating Bitcoin into its ecosystem, however Bitcoin stays impartial and resilient, free from reliance on any single entity, even an business big like Apple. There’s little question that Apple’s fast survival doesn’t hinge on embracing Bitcoin. Nevertheless, complacency fosters stagnation, and over time, the corporate could face rising challenges if it neglects to harness the potential of Bitcoin.

Whereas I admire Steve Jobs’ brilliance and his dedication to his imaginative and prescient, I imagine that Satoshi Nakamoto’s community-centric strategy was higher suited to what he was creating. Bitcoin evolves by way of decentralized governance, the place choices about its improvement are made collectively by its world consumer base. This ensures that the digital forex stays adaptable and conscious of the wants and preferences of its customers. It additionally makes it tough for individuals to “transfer quick and break issues” which will be disruptive and dangerous in a monetary system individuals all around the world are utilizing as a retailer of worth.

The energy and flexibility of Bitcoin owe a lot to the absence of a solitary central determine. It was not the brainchild of a lone particular person; in reality, Satoshi cited the work of eight others within the authentic white paper. Whereas Nakamoto launched the community, Bitcoin has since advanced by way of the contributions of many builders and group members. And not using a solitary chief to focus on, Bitcoin has confirmed adaptable and resilient amid free market forces and waves of scrutiny. Although people come and go, transformative concepts can stay on and alter the world. Because the movie V for Vendetta famous, highly effective ideas can outlast anybody individual: “We’re informed to recollect the thought, not the person, as a result of a person can fail. He will be caught, he will be killed and forgotten, however 400 years later, an thought can nonetheless change the world.” Bitcoin’s decentralized ethos embodies this spirit of an thought taking up a lifetime of its personal.

In distinction to Bitcoin’s decentralized beginnings, Apple’s success is basically attributed to the imaginative and prescient and management of 1 man. What made Steve Jobs so profitable is how he seamlessly mixed artwork, music, and creativity into merchandise that folks emotionally related with. Steve was glorious at evoking individuals’s emotion by way of considerate design and advertising. Whereas Bitcoin and Apple took very completely different paths, they each reveal how an incredible thought, whether or not championed by one chief or many, can profoundly affect the world.

Innovation thrives on the crossroads of various disciplines. Within the context of Bitcoin’s immense potential, I’d prefer to suggest a imaginative and prescient of how Apple might harness this interdisciplinary strategy to not solely honor its legacy but in addition embrace the longer term.

1. Consumer-Pleasant Bitcoin Integration: Apple’s knack for seamlessly mixing expertise with consumer expertise is known. Collaborations between pc scientists, UX designers, and educators might yield distinctive instruments and sources to demystify Bitcoin for the plenty. Think about integrating lightning funds into Apple Pay, simplifying Bitcoin transactions and probably eliminating the necessity to share income with banks and bank card suppliers. The user-friendly expertise might redefine digital funds.

2. Regulatory Collaboration: In navigating the advanced regulatory panorama, Apple might work alongside authorized consultants and economists to develop clear frameworks. By demonstrating a dedication to balancing innovation with client safety, Apple can win the belief of regulators and lawmakers. This proactive stance might pave the best way for Bitcoin’s wider acceptance and reduce the necessity for protracted litigation battles.

3. Monetary Companies Revolution: Collaborating with fintech consultants and builders, Apple might design monetary services and products that harness Bitcoin’s energy whereas making certain safety and compliance. A notable problem is the absence of chargeback mechanisms in Bitcoin. Right here, Apple might innovate by exploring options that protect Bitcoin’s core tenets of trustlessness and immutability whereas providing customers elective chargeback mechanisms by way of trusted third events.

Whereas some purists could resist the thought of chargebacks, the objective is to strike a stability and let Bitcoiners resolve on the tradeoffs they’re keen to make. By fostering innovation on this space, Apple may also help Bitcoin accommodate a wider vary of customers and use circumstances.

4. Societal Impression: It’s my perception that Bitcoin is usually a pressure for societal betterment, selling monetary inclusion, financial improvement, and particular person sovereignty. As a substitute of dismantling present methods, Bitcoin presents a means to enhance them. It’s disheartening to see Apple, as soon as recognized for its rebellious spirit, shrink back from such a chance.

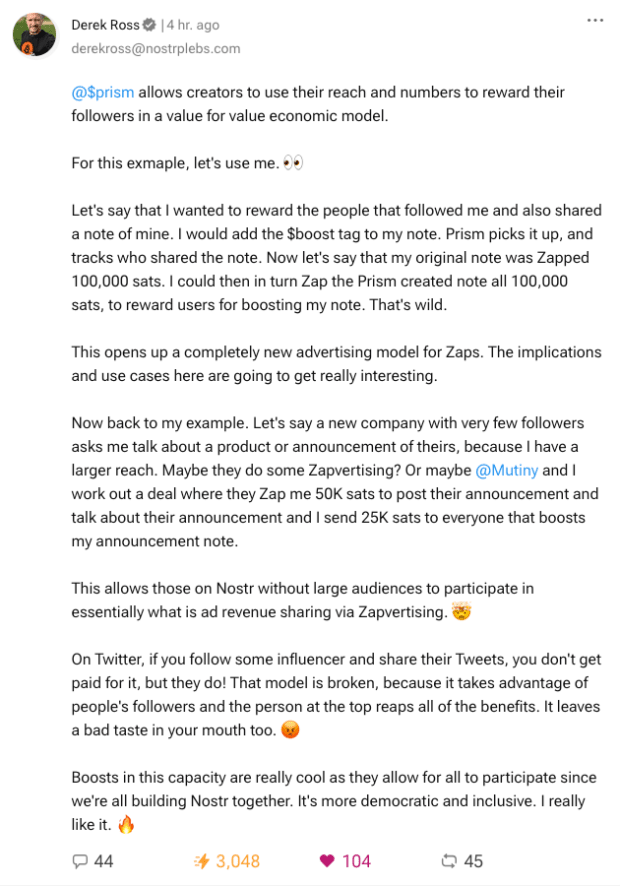

Think about a world the place individuals can ship micropayments over social media to straight assist one another’s creativity and content material. Applied sciences like Bitcoin’s Lightning Community and the decentralized Nostr protocol are making this doable.

Moderately than viewing this as a risk to centralized app retailer charges and management, Apple might embrace and speed up such innovation. Seamless Bitcoin/Lightning and Nostr integration on Apple units could unlock new financial and artistic alternatives globally.

The spirit of decentralized innovation aligns with beliefs of freedom and empowerment. Enabling individuals to straight trade worth could seed groundbreaking concepts. As Apple is aware of properly, creativity and innovation thrive when restrictions are eliminated.

If Apple faucets into the promise of Bitcoin’s lightning-fast micropayments and decentralized platforms like Nostr, they may propagate far-reaching financial and artistic empowerment worldwide. The long run will belong to those that don’t simply optimize present fashions however reimagine expertise’s relationship with freedom and humanity.

This can be a visitor publish by Conor Chepenik. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.