The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

As we get nearer and nearer to the approaching Bitcoin halving, the mixed pressures of wildly growing demand and shrinking provide have created an uncommon market, turning a traditionally constructive omen into an explosive alternative for revenue.

The Bitcoin ETF approval has modified the face of Bitcoin as we all know it. Because the SEC made its fateful resolution in January, the resultant developments have brought about worldwide upheaval; billions have flown into these new funding alternatives, and regulators in lots of international locations are contemplating the position of Bitcoin within the monetary institution. Regardless of some preliminary setbacks, the market has comfortably hit new all-time highs, and the value has stayed in a really spectacular vary even regardless of fluctuations.

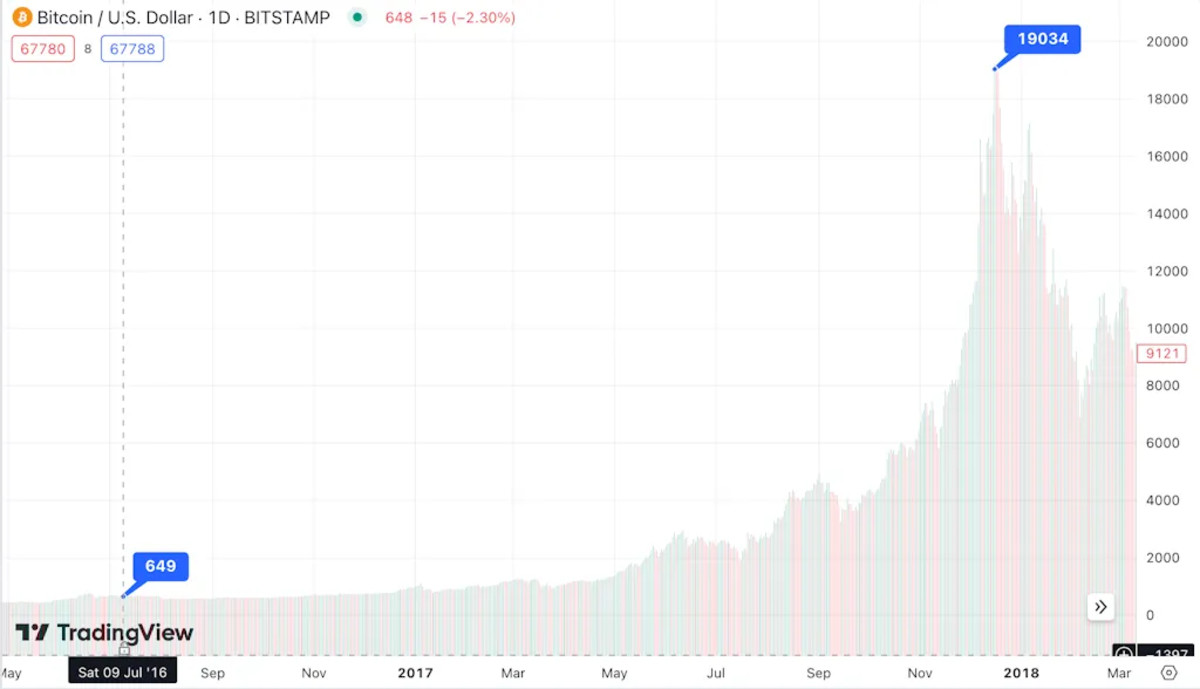

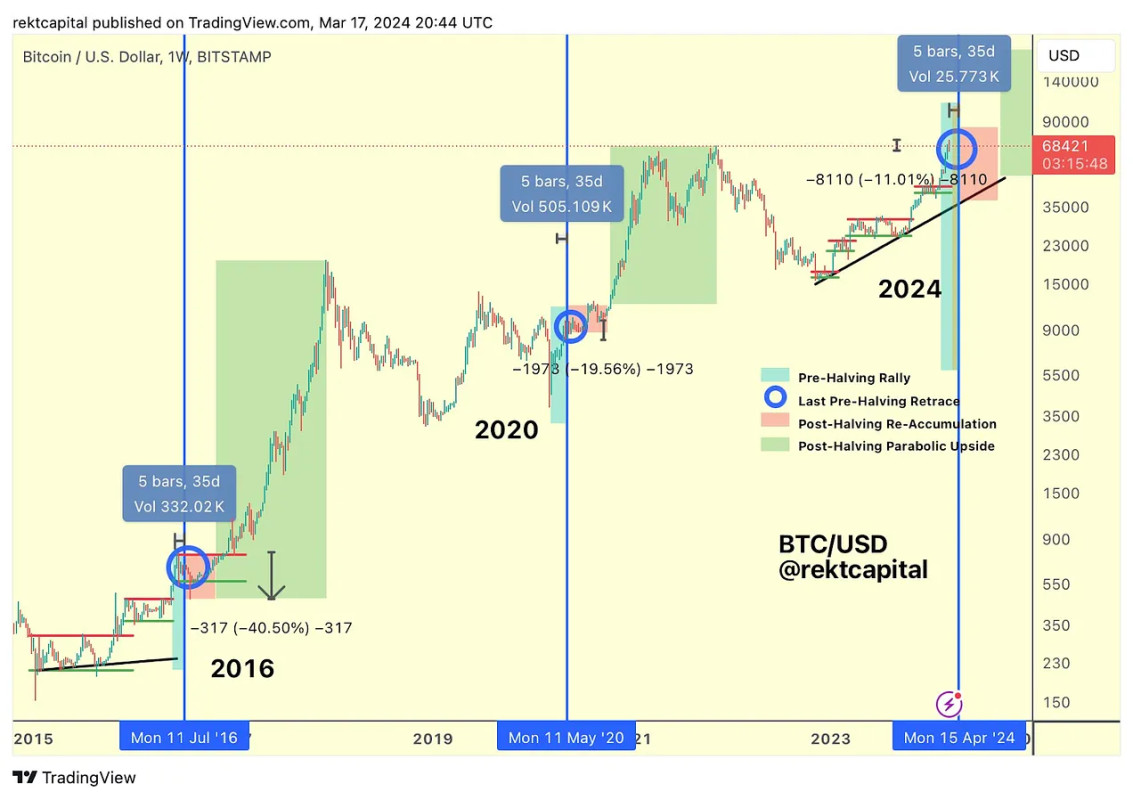

However, we’re in a really distinctive scenario that may impression the market in unpredictable methods. Bitcoin’s subsequent halving is about to reach in April, and this would be the first time in its whole historical past that the halving will coincide with an all-time excessive for value. Though there have been a substantial amount of variations between every of the foremost halvings, a development has been usually noticeable: even when there are enormous regular positive aspects, it’s within the ballpark of a 12 months to 18 months earlier than Bitcoin breaks all data with a real value spike. One 12 months out from the halving in June 2016, Bitcoin had greater than doubled; but just a few months later, the expansion was nearer to 30x.

There may be loads of optimism from substantial trade gamers, corresponding to Customary Chartered’s daring prediction that Bitcoin’s worth will greater than double to $150k earlier than the 12 months is over. Nonetheless, their evaluation of the scenario is just not largely primarily based on halving tendencies however on the rampaging success of the Bitcoin ETF, and that success has additionally thrown us a curveball. As group dialogue has been fast to level out, these main ETF issuers have been pouring billions into bitcoin, shopping for at astounding charges and amassing a number of the world’s largest Bitcoin provides virtually in a single day. In the event that they collectively buy greater than even the worldwide group, how will they react when the spigot of latest cash shuts to a trickle?

In different phrases, we’re headed right into a scenario the place demand is at an all-time excessive and there’s inadequate provide to fulfill it. Enterprise Insider known as the upcoming halving a “momentous occasion”, contemplating that the ETF had made “everlasting modifications to Bitcoin’s underlying infrastructure.” Coinshares echoed these sentiments with the warning of a constructive demand shock, as Head of Analysis James Butterfill claimed that “The launch of a number of spot bitcoin ETFs on January 11 has led to a mean every day demand of 4500 bitcoins (buying and selling days solely), whereas solely a mean of 921 new bitcoin had been minted per day.” And that’s solely contemplating the pre-halving mining charges. The ETF issuers are already counting on secondhand Bitcoin gross sales to refill their coffers, and this development appears sure to extend within the quick future.

Isn’t this a superb factor, although? Optimistic demand shocks, as a rule, are usually related to jumps in value. Moreover, regardless that shocks like this in important commodities like oil can result in inflation, Bitcoin is just not but an integral part of the complete world economic system. It’s unlikely that the identical drawbacks will apply simply but. In different phrases, the reply is usually sure, however the scenario can nonetheless trigger alarming tendencies. For instance, the evening of March 18 noticed a really bewildering improvement: coasting at highs round $70k, Bitcoin’s worth on BitMEX crashed beneath $9k within the blink of a watch. The value recovered shortly and was, in any occasion, remoted to this one change, however it’s nonetheless an unprecedented improvement.

BitMEX introduced that the perpetrator of this detrimental value spike was a collection of huge promote orders in the midst of the evening, and that they had been investigating the exercise. A number of nameless whales specifically have emerged because the probably candidates for these gross sales. We nonetheless do not know who precisely they’re or who was shopping for bitcoins at such a prodigious price, however it’s solely an instance of how main selloffs can torpedo market confidence. In any occasion, this one episode is barely a very sharp instance of a common development; “fixed” spot promoting as Bitcoin’s value receives a bloody nostril. The market hit lows of $62k Tuesday afternoon, whereas it was almost at $72k on the morning of the earlier Friday.

Merchants have nonetheless remained completely optimistic that these value dips are nothing greater than the “bear lure” related to the pre-halving setting, and so they aren’t the one ones. Outstanding executives together with Binance CEO Richard Teng and Crypto.com CEO Kris Marszalek have endorsed the perspective that these sorts of value dips are a wonderfully pure and non permanent part of a scheduled halving. There’s a clearly observable development of considerable value dips, from 20-40%, within the weeks instantly previous to the newest halvings. And but, the value bounced again shortly and utterly, and went on to new all-time heights.

In different phrases, a number of the current and sudden value dives are totally explainable utilizing knowledge from Bitcoin’s historical past. The related questions for us, then, are whether or not Bitcoin’s future will comply with the identical line. The very fact of the matter is that each one the accessible indicators level to an optimistic long-term forecast. A constructive demand shock attributable to ETF acquisitions and the halving could very effectively make it harder for a mean shopper to purchase bitcoin, however how will that issue manifest? Greater costs. In addition to, a promoting level of the ETF is that loads of common shoppers will use it to hunt publicity to bitcoin’s income, fairly than direct custody. This alone will encourage ETF issuers to maintain their shopping for strain excessive. It’s not possible to say how lengthy this market scenario will proceed or what it is going to imply for bitcoin’s use as an precise foreign money, however there’s nothing within the present scenario to recommend that bitcoin gained’t continue to grow.

Is it any marvel, then, that the group is gearing as much as welcome the halving with such bated breath? Outstanding trade figures are taking nice care to organize “The Largest Celebration in Bitcoin” with dwell protection and meetup occasions in 7 international locations (and counting), and the halving isn’t even anticipated for one more month. It’s very attainable that 2024 will likely be remembered because the 12 months that Bitcoin really grew to become enmeshed within the world monetary infrastructure, if gorgeous regulatory victories in January flip to unprecedented development by December. Actually, the foremost important concern is whether or not or not Bitcoin will see diminished utilization as a foreign money when its value in fiat is so precious. However, the indicators from proper now appear fairly clear: Bitcoin is about to blaze a path into the long run.