Crypto exchanges have lately been making strikes to streamline their choices, and an unprecedented variety of digital tokens are being proven the exit. As Bitcoin instructions renewed curiosity and experiences a revival, it’s ironic to witness quite a few different tokens getting the chop from main platforms.

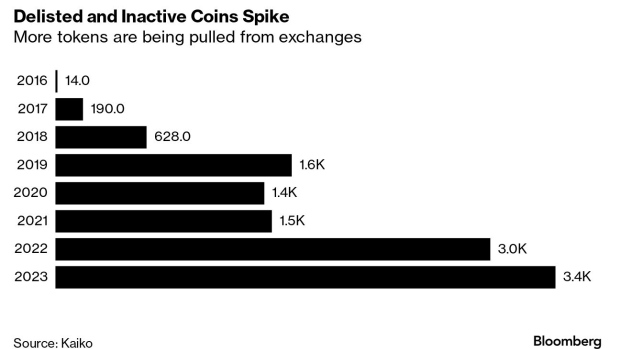

In accordance with knowledge compiled by Kaiko, the numbers are clear: 3,445 tokens or buying and selling pairs are on the chopping block, having been rendered inactive or slated for imminent delisting. In a comparative evaluation, this determine overshadows final 12 months’s numbers by 15% and even doubles these of the 12 months prior, as reported by Bloomberg.

Main Exchanges Taking The Lead

Coinbase World Inc. and Binance, the 2 behemoths in cryptocurrency exchanges, have been proactive on this culling train. Surprisingly, this month alone has seen over 100 tokens being delisted from these platforms.

Knowledge from researcher CCData pinpoints that Coinbase eliminated 80 pairs simply in October – an unparalleled month-to-month determine for the 12 months. In the meantime, one other important participant, OKX, has already culled 172 tokens this 12 months, with Coinbase not far behind at 176 pairs.

The numbers could appear alarming, however there’s extra to the story. Regardless of the sheer quantity of tokens obtainable, buying and selling volumes throughout most exchanges have taken a major hit over the past 12 months. Over 1.8 million tokens are up for commerce throughout centralized and decentralized platforms.

In accordance with Bloomberg, liquidity has turn into uncommon after occasions like FTX’s scandals and ensuing bankruptcies. Many exchanges, in response, are opting to funnel it in the direction of extra in style and user-favored buying and selling pairs.

Jacob Joseph, an analyst at CCData, sheds mild on this crypto exodus. In accordance with him, the technique to remove fragmented liquidity goals to refine the buying and selling expertise for customers. This tactic can considerably scale back unfold and slippage prices, making trades extra favorable for customers.

Nevertheless, Bloomberg additional disclosed that exterior pressures are contributing to this development. Notably, regulatory interventions have performed an element.

As an illustration, the US Securities and Change Fee (SEC) has lately categorised 19 tokens as unregistered securities, prompting exchanges like Coinbase and Binance to delist them, thereby staying within the regulator’s good graces.

The Greater Image

Though these delistings is likely to be abrupt, they align with the final crypto market’s restoration trajectory. Since December, the 100 most important tokens have surged by roughly 60%, bouncing again from a 66% stoop the earlier 12 months.

In accordance with Bloomberg, delistings should not a novel phenomenon. 2018, the crypto world skilled an analogous development when quite a few tokens bit the mud. This decline was mainly as a result of failed startup ventures that had banked closely on preliminary coin choices (ICOs) and a stringent world crackdown on doubtful actions and scams.

Riyad Carey, an analyst at Kaiko, provides a closing perspective, noting:

That is the results of an explosion within the variety of tokens, in addition to [the] aggressive itemizing of those tokens, over the last bull market. Many of those tokens/initiatives have light away or folded within the bear market and liquidity and volumes are at multi-year lows, and exchanges will delist pairs that don’t generate sufficient in charges.

Whatever the departure, the worldwide crypto market has been in for a bullish development over the previous 24 hours, up by practically 10%, with a present valuation above $1.2 trillion. This spike comes notably as a result of Bitcoin’s current rally as a result of a possible approval of spot BTC exchange-traded fund (ETF).

Featured picture from Unsplash, Chart from TradingView