The Bitcoin value has risen above $35,000 for the primary time since early Could 2022, for which there are a variety of causes past mere hypothesis. These are the 5 most necessary causes.

#1 BlackRock’s Spot Bitcoin ETF Approval Looms Massive

The first driver behind the surge appears to be the rising anticipation surrounding the attainable inexperienced mild for a Spot Bitcoin ETF. The epicenter of this surge is the potential approval of BlackRock’s spot Bitcoin ETF.

Fueling these speculations was a revelation from Scott Johnsson, a revered finance lawyer from Davis Polk. He famous, “So two issues caught my eye from the newest iShares (Blackrock) S-1 modification: They’ve obtained a CUSIP in preparation for a launch. They could be trying to seed with money this month.”

This sentiment was additional amplified by a picture making rounds on X, highlighting the BlackRock iShares Bitcoin Belief’s itemizing on the Depository Belief & Clearing Company (DTCC) with the ticker IBTC. Including depth to those rumors, Bloomberg’s Eric Balchunas commented, “The iShares Bitcoin Belief has been listed on the DTCC. And the ticker might be $IBTC. Once more all a part of the method of bringing an ETF to market.”

Nevertheless, James Seyffart from Bloomberg threw in a notice of warning by mentioning, “There isn’t any set time. Might actually be days, or months or years theoretically.”

#2 Grayscale’s ETF Dispute Reaches A Conclusion

Yesterday marked a major juncture within the extended tussle between Grayscale and the U.S. Securities and Change Fee (SEC). The DC Circuit Courtroom of Appeals put an finish to the courtroom case, compelling the SEC to revisit its earlier choice to say no Grayscale’s proposal to transition its Grayscale Bitcoin Belief (GBTC) right into a spot ETF.

This conclusion by the courtroom affirms its preliminary judgment from two months prior, whereby it critiqued the SEC’s denial as being “arbitrary and capricious.” The SEC shunned interesting the ruling, making the courtroom’s newest motion procedural.

The onus now shifts again to the SEC, leaving it with the selection to both sanction Grayscale’s software or to spurn it primarily based on various grounds. This occasion, albeit procedural, enhances the narrative suggesting an impending spot ETF approval by the SEC.

#3 Bitcoin Brief Sellers Are Squeezed

A big portion of the market was caught on the unsuitable foot. Brief vendor bought rekt. Coinglass’s information reveals {that a} whopping $161 million in BTC futures shorts had been liquidated simply yesterday, with a further $35 million already at present. Drawing consideration to this development, Julio Moreno, CryptoQuant’s head of analysis, identified:

The surge in Bitcoin’s value has been primarily fueled by quick sellers having to cowl. As costs soared previous $31K, we noticed a notable drop in Open Curiosity. It’s intriguing to see a rally that doesn’t primarily begin with everybody going lengthy.

Including to the narrative, Joe Consorti, a market analyst with The Bitcoin Layer, remarked, “as Bitcoin surged to $31,000, there was a noticeable accumulation of futures positions, paying homage to the rally we noticed from $25k to $30k in late June. Worth surges pushed by leverage will be precarious, akin to buildings constructed on unstable grounds.”

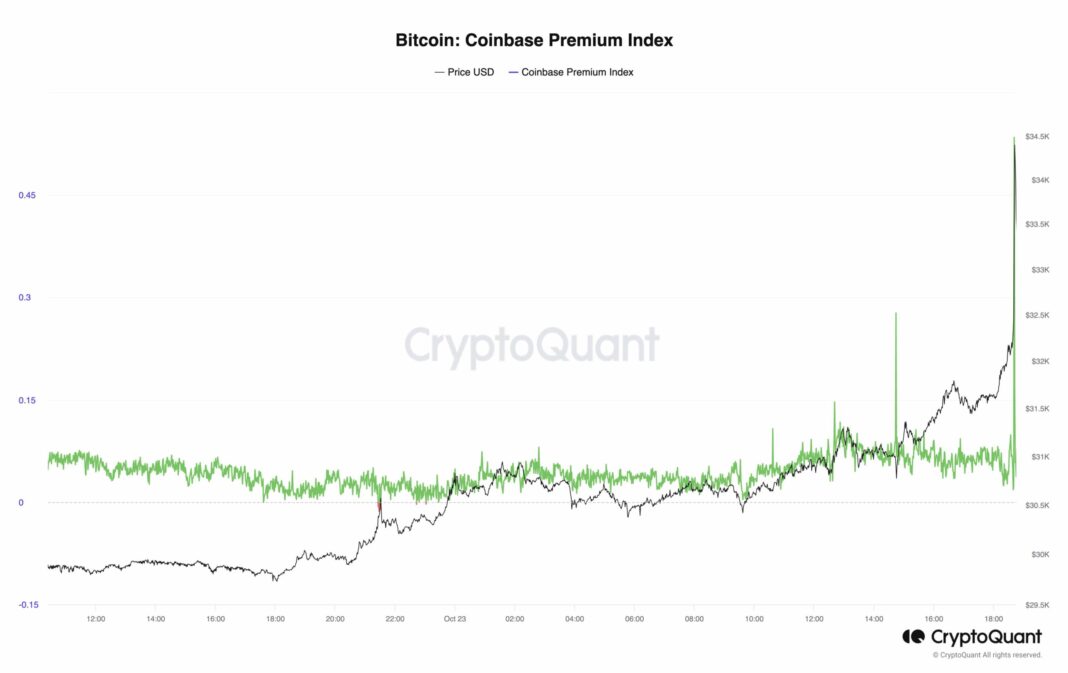

#4 Emergence Of TWAP Shopping for And Coinbase Premium

In an evaluation that has intrigued many within the crypto neighborhood, Skew, a well-regarded analyst, highlighted an attention-grabbing sample in Bitcoin’s buying and selling. “There’s a discernible TWAP purchaser that has been lively since Bitcoin hit round $30.6K. The affect of this TWAP shopping for on the value trajectory appears extra pronounced this time round,” Skew noticed.

Digging deeper into the numbers, he added, “If we’re estimating, it seems to be about 500k clips roughly each hour, which might equate to about $6 million. Over 5 such situations, this may accumulate to $30 million.”

For these unfamiliar, TWAP, or “Time Weighted Common Worth,” is an algorithmic buying and selling technique. Its purpose is to execute orders over a sure timeframe, making certain that the common value throughout that interval is achieved. This technique is very helpful for big orders, serving to mitigate any drastic value shifts available in the market. Primarily, it signifies a significant participant, presumably an institutional investor, making important Bitcoin acquisitions.

Skew additionally touched upon the Coinbase issue: “BTC Coinbase Spot: With such aggressive TWAP shopping for, there must be substantial liquidity to cater to such a purchaser. Presently, market makers appear to be those offloading to this purchaser. If we peek on the order e book, there seems to be a slight skew in the direction of extra ask liquidity across the $37K mark.”

This remark aligns with the insights of CryptoQuant CEO Ki Younger Ju, who commented on the sudden spike within the BTC Coinbase premium, stating, “BTC Coinbase premium simply skyrocketed.”

#5 Max Ache For Gamma Shorts In The Choices Market

The usually-complex panorama of the choices market has additionally performed a pivotal position in shaping Bitcoin’s value transfer. Alex Thorn, the Head of Firmwide Analysis at Galaxy, drew consideration to this phenomenon, stating, “We’re approaching max ache for gamma shorts.”

Yesterday, NewsBTC reported a major perception: the style through which choices market makers in Bitcoin had been positioning themselves had the potential to intensify the depth of any upward value trajectory for Bitcoin within the quick time period. Alex Thorn elaborated on this, noting, “Choices market makers in Bitcoin are more and more quick gamma as BTC spot value strikes up. […] This could amplify the explosiveness of any short-term upward transfer within the close to time period.”

Additional underlining this development, Thorn pointed to information from Amber and defined, “At $32.5k, market makers want to purchase $20 million of delta for each subsequent 1% transfer increased.” Thorn’s evaluation seems to have been spot-on.

At press time, BTC traded at $34,029.

Featured picture from CryptosRus, chart from TradingView.com