The Bitcoin worth continues to compress round its present ranges, however throughout as we speak’s buying and selling session, there was an uptick in volatility. The rise on this metric may trace at a shift within the narratives influencing BTC’s worth motion.

As of this writing, Bitcoin trades at $29,300 with sideways motion within the final 24 hours. Within the earlier seven days, the cryptocurrency noticed related motion pushing different belongings in an identical path or no path because the sector flatlines within the quick time period.

Bitcoin ETF Turns into Dominant Narrative In Crypto Market?

In a latest market replace, crypto evaluation agency Blofin pointed to an uptick in market sentiment. Coupled with an increase in volatility, market contributors are reacting to the potential announcement from the US Securities Trade Fee (SEC) round a spot Bitcoin ETF.

The Fee is about to rule on asset supervisor Grayscale’s petition to rework their Grayscale Bitcoin Belief (GBTC) into an ETF. The choice was supposed to come back out as we speak, Blofin said, however it may drag on till this Friday, August 18th.

If the SEC postpones the choice for any motive, because it did with Ark’s petition, the market will possible preserve transferring sideways. In that sense, improvement across the ETF choice is gaining energy over macroeconomic dynamics.

This modification in dynamics is extra evident within the derivatives sector, with choices merchants changing into extra bullish for the approaching months. Blofin famous the next on this dynamic:

(…) The information above (on the Bitcoin ETF approval) has promoted the fast rise of short-term bullish sentiment and uncertainty available in the market (…). It seems that buyers are ready for excellent news associated to the spot Bitcoin ETF.

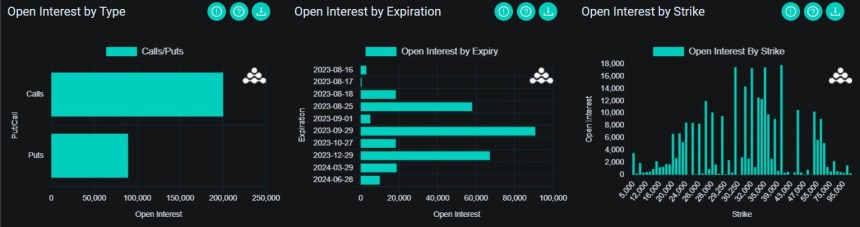

And “sensible” merchants are positioning accordingly. The report notes that the open curiosity for choices contracts is skewed to the decision (purchase) aspect.

As information from the derivatives platform Deribit exhibits, merchants are betting that the worth of Bitcoin will rise above $30,000 by the tip of August or September. As seen on the chart beneath, 57,000 contracts will expire by the tip of this month and 90,700 subsequent month.

Coupled with the rise in Open Curiosity skewed to the decision aspect, the chart above exhibits that merchants are betting on a Bitcoin rally above $30,000 to $40,000. The spot BTC ETF choice will transfer the market, significantly on the finish of August and September.

Cowl picture from Unsplash, chart from Tradingview