Bitcoin (BTC) worth declined by 2.7% up to now 24 hours because the US Federal Reserve (Fed) seems poised to provoke its broadly anticipated rate-cut cycle this week.

Why Did Bitcoin Decline Forward Of Price Cuts?

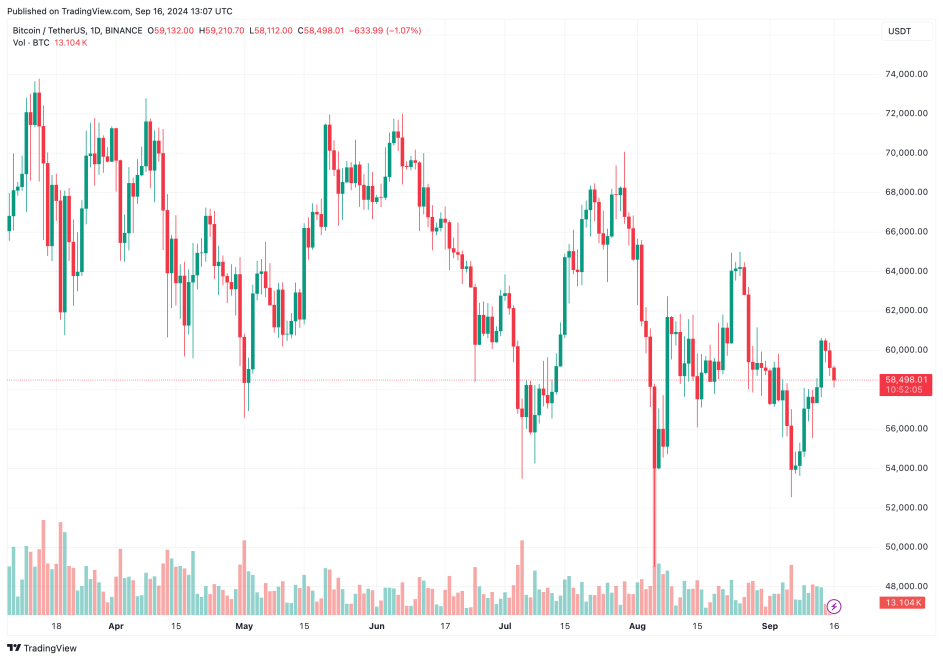

Hovering round $60,000 all through a lot of the weekend, BTC worth skilled a stoop of two.7% forward of the Fed’s anticipated charge cuts prone to start this week. Curiously, the worth motion exhibited by the most important cryptocurrency by market cap aligns with the prediction by former BitMEX alternate CEO, Arthur Hayes.

Assuming the Fed decides to provoke charge cuts this week, it is going to be the primary in 4 years that rates of interest will likely be slashed amid easing inflation to stimulate the economic system.

Information from Polymarkets signifies that bettors are giving it a 57% probability that the Fed cuts charges by 50 foundation factors (bps), whereas the chances for a 25 bps are at 42% at press time.

After the unprecedented COVID-induced cash printing in 2020, the Fed had a tricky problem in tackling surging inflation on the again of supply-chain bottlenecks and forex debasement. Consequently, the Fed launched into a rate-hike cycle in March 2022, with the final rate-hike achieved in July 2023.

Usually, charge cuts are seen as a bullish growth as they decrease borrowing prices for companies, growing their urge for food for dangers and enabling them to broaden their operations. Naturally, it is usually anticipated that among the recent financial stimulus is absorbed by risk-on belongings equivalent to shares or cryptocurrencies, propelling them increased.

Nonetheless, issues will not be trying as routine this time round as many specialists have opined that charge cuts may not have the anticipated impact on risk-on belongings. There will be numerous causes behind this evaluation.

As an example, charge cuts throughout occasions of financial uncertainty and excessive unemployment may ship a sign to traders that the Fed is in damage-control mode and isn’t too assured within the present well being of the economic system to keep away from heading into a possible recession.

Equally, charge cuts might be an instance of a ‘purchase the rumor, promote the information’ occasion. In such conditions, savvy traders are likely to drive up the worth of risk-on belongings in anticipation of simpler financial situations after the initiation of the rate-cut cycle.

Because the occasion approaches – on this case, the speed cuts – traders may promote these belongings to e book their earnings, leading to a worth decline earlier than the official charge minimize.

Value declines in risk-on belongings forward of anticipated charge cuts may additionally stem from fears surrounding cussed inflation. Whereas the headline Shopper Value Index (CPI) knowledge for August 2024 got here in decrease than anticipated, core CPI was barely increased than financial forecasts, indicating that the battle in opposition to inflation hasn’t been decisively gained but.

Can US Presidential Elections Ignite One other Bullish Momentum?

Whereas the panic earlier than charge cuts may harm Bitcoin and cryptocurrency costs within the short-term, one other main occasion that would determine the longer term worth trajectory of digital belongings is the US Presidential Elections.

Republican candidate and former President Donald Trump has voiced his help for the crypto business on numerous events. A latest report by Bernstein predicted that BTC may attain as excessive as $90,000 in This fall 2024 if Trump wins the election.

Nonetheless, a Kamala Harris win may ship the main cryptocurrency to check worth ranges as little as $30,000. At press time, Bitcoin is buying and selling at $58,498, down 2.7% within the 24 hour timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com