The protracted authorized confrontation between Ripple Labs Inc. and the US Securities and Alternate Fee (SEC) is advancing in direction of a vital juncture, as each events face imminent deadlines for his or her cures briefing submissions. This section of the authorized battle marks a major step within the proceedings, doubtlessly setting the stage for the case’s potential decision.

Lawyer James Ok. Filan highlighted the upcoming schedule on X at present, noting key dates: the SEC’s opening temporary is due on March 22, adopted by Ripple’s opposition temporary by April 22, and concluding with the SEC’s reply temporary slated for Might 6.

#XRPCommunity #SECGov v. #Ripple #XRP Beneath is the revised schedule for cures briefing: (1) @SECGov’s opening temporary is due on March 22, 2024, (2) @Ripple’s opposition temporary is due on April 22, 2024, and (3) @SECGov’s reply temporary is due Might 6, 2024.

— James Ok. Filan 🇺🇸🇮🇪 (@FilanLaw) March 14, 2024

These dates come after Ripple was granted a one-week extension in February for remedies-related discovery, shifting the deadline from February 12 to February 20. This extension was necessitated by a ruling in favor of the SEC by Choose Sarah Netburn, which required the corporate to supply a considerable quantity of paperwork on the XRP gross sales for 2022-2023 inside a constrained timeframe.

Furthermore, in late February, the SEC, represented by Jorge G. Tenreiro, sought an extra week to file remedies-related briefing to Choose Analisa Torres. This request was geared toward permitting ample time for the evaluate of not too long ago produced paperwork and the finalization of their briefing, a transfer that Choose Torres authorized in early March.

What To Anticipate From The Ripple Vs. SEC Treatments Briefing?

In line with John Deaton, an advocate for XRP, a settlement between each events appears off the desk for the second. In current weeks, he candidly mentioned the case’s trajectory, emphasizing the absence of settlement discussions between each events.

Deaton’s observations replicate a stern authorized stance from the SEC, highlighted by their movement to compel Ripple to launch its audited monetary statements for 2022–2023 together with particulars on institutional gross sales post-complaint, a transfer Deaton interprets as “scorched earth litigation.”

Reflecting on the SEC’s steadfast strategy, Fred Rispoli, one other voice from the XRP group, not too long ago expressed preliminary optimism for a de-escalation however acknowledged the intensifying focus of the case. Rispoli’s remarks underscore the gravity of the SEC’s calls for for monetary documentation post-lawsuit submitting, suggesting a strategic transfer to scrutinize Ripple’s present operational compliance.

He speculated, “The final word takeaway is that the SEC remains to be going after the jugular for Ripple to limit/kill its institutional operations. This complete briefing goes to give attention to Ripple’s present operations and the way they’re completely different from what bought whacked within the MSJ. The stakes are nonetheless very excessive (for Ripple not XRP) sadly.”

Deaton, referring to the potential monetary repercussions for Ripple, proposed that the fines might vary “from $10 million to $100 million,” a determine considerably lower than the estimated $200 million Ripple has expended on its authorized protection. Deaton’s outlook stays eager for appellate help of Choose Analisa Torres’s choices relating to the sale and distribution of XRP, envisaging the cures section as a complete authorized problem in itself.

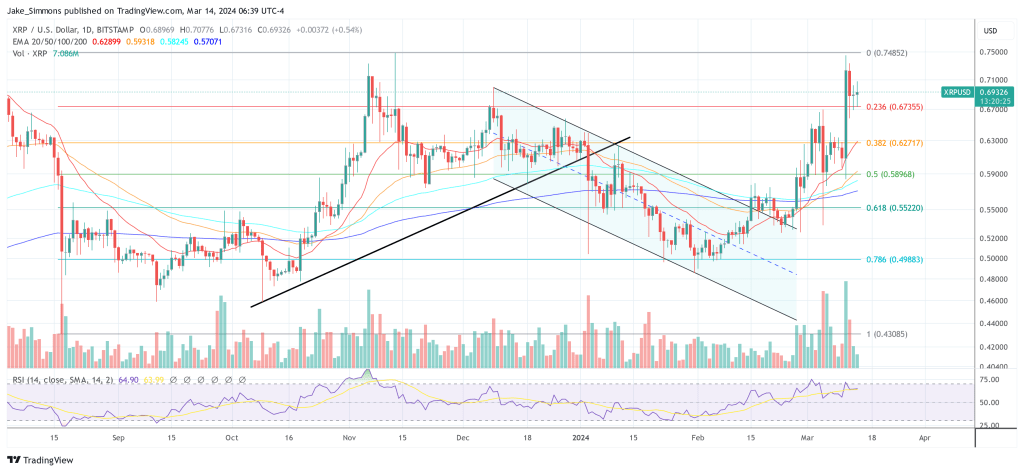

At press time, XRP traded at $0.693.

Featured picture created with DALL E, chart from TradingView.com