Bitcoin ETFs (exchange-traded funds) had one other constructive efficiency over the previous week, with billions of {dollars} flowing into the crypto funding merchandise.

Bitcoin ETFs: $2.2 Billion Inflows Over The Previous Week

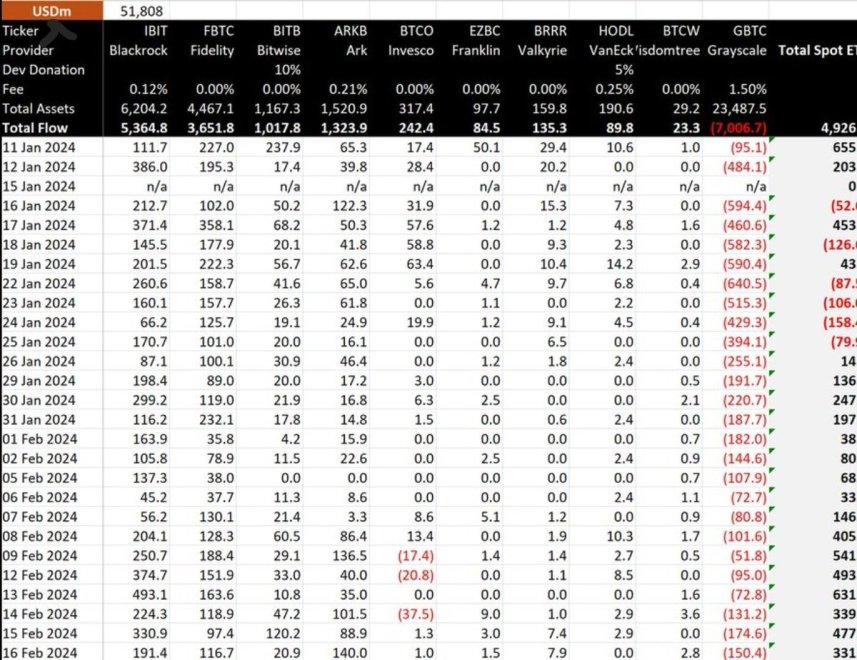

The newest knowledge by BitMEX Analysis exhibits that the Bitcoin spot ETFs recorded greater than $2.2 billion in complete inflows between February 12 and February 16. In keeping with Bloomberg analyst Eric Balchunas, this determine is greater than some other exchange-traded product in the USA took in over the past seven days.

As anticipated, BlackRock’s IBIT amassed the majority of this capital, because it continues to guide the pack within the spot ETF race. The fund attracted greater than $1.6 billion previously week alone, bringing its web flows to $5.2 billion.

Eric Balchunas famous in his put up on X:

$IBIT alone has taken in $5.2b YTD, which is 50% of BlackRock’s complete web ETF flows, out of 417 ETFs.

Bitcoin ETFs day by day flows | Supply: BitMEX Analysis

BlackRock’s funding product was adopted by Constancy’s FBTC, which posted about $648.5 million in web inflows between February 12 and February 16. In third place was Ark Make investments’s BTCO, which has greater than $1.3 billion in complete flows since January 11, the day spot Bitcoin ETFs began buying and selling within the US.

Grayscale’s GBTC witnessed a complete outflow of about $623 million over the previous week. This determine represents a rise in GBTC outflow when in comparison with the earlier week’s $411 million.

The importance of the general constructive flows into the spot Bitcoin ETFs can already be seen within the value of cryptocurrency, which rose to its highest degree in additional than two years over the previous week. The Bitcoin value surpassed the $52,000 mark on Thursday, February 15.

ETF Buying and selling Quantity On The Rise

In keeping with a latest Santiment report, Bitcoin ETFs’ buying and selling quantity has been on the rise for the reason that begin of February. The on-chain analytics revealed that the 7 prime spot ETFs registered greater than $1.8 billion of buying and selling quantity per day within the first half of the month.

📊 #Bitcoin‘s #ETF buying and selling quantity has started thriving as soon as once more right here in mid-February. Over $1.8B of buying and selling quantity per day is happening between the 7 most notable ETF’s (GBTC, IBIT, FBTC, ARKB, BTCO, BITB, HODL). Significantly as $BTC crossed above $50K earlier

(Cont) 👇 pic.twitter.com/4f3ZJjyZLz

— Santiment (@santimentfeed) February 16, 2024

In reality, Santiment related the latest spurt within the value of Bitcoin with the explosion in BTC ETF buying and selling quantity. The analytics platform mentioned:

Significantly as BTC crossed above $50K earlier this week, we noticed an explosion of assist coming in through these ETFs.

As of this writing, Bitcoin is valued at $51,326, reflecting a 1.3% value decline previously 24 hours.

Bitcoin value at $51,598 on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Shutterstock, chart from TradingView