In response to blockchain investigator ZachXBT, Circle had been earning profits from transactions in keeping with the infamous North Korean hacking group Lazarus Group, a extreme accusation lodged in opposition to the corporate.

The allegation comes after an incident by which Circle took greater than 4 months to delay its blacklisting of funds related to the group–greater than a full length longer than that taken by different main stablecoin issuers.

ZachXBT used social media to vent his resentment by drawing consideration to Circle’s general platform-wide failing of their struggle in opposition to cash laundering.

He stated:

“Not as soon as have you ever ever blacklisted after a DeFi exploit/hack when there was ample time, whilst you proceed to revenue off the transactions.”

The Lazarus Group Hack

The Lazarus Group was additionally seen as answerable for the current hack of the Indonesian crypto trade Indodax, which occurred on 11 September. This hack has resulted within the theft of over $20 million from this trade, leaving it briefly closed right down to assess injury suffered.

Fuck Circle Fuck @jerallaire you don’t care in any respect in regards to the ecosystem besides extracting from it.

Not as soon as have you ever ever blacklisted after a DeFi exploit / hack when there was ample time whilst you proceed to revenue off the transactions.

You took 4.5 months longer than each… https://t.co/9TFn11UERU

— ZachXBT (@zachxbt) September 14, 2024

As soon as absolutely investigated, Indodax had opened itself as much as additional companies, steadily resuming deposit and withdrawal companies, in addition to staking companies.

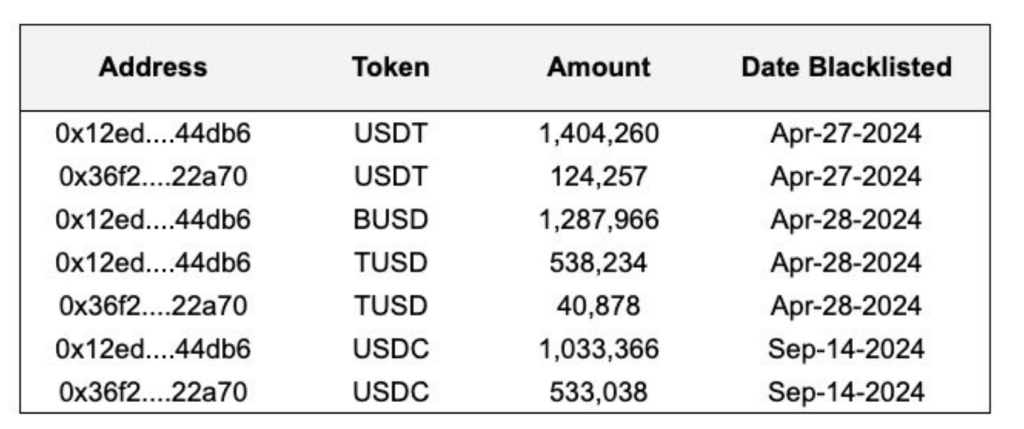

ZachXBT reported that 4 stablecoin issuers, together with Tether, Circle, Paxos, and Techteryx, have blacklisted two addresses related to the Lazarus Group, which maintain a mixed $4.96 million in numerous stablecoins.

Supply: ZachXBT

Other than the frozen blacklisted funds, the exchanges have already frozen one other $1.65 million belonging to the hackers. So, which means the full quantity of frozen cash now stands at about $6.98 million. To date, the continued probe exhibits a disturbing pattern: the stablecoins are being utilized to launder the stolen funds.

There may be proof that Lazarus Group had managed to launder round $200 million from numerous crypto exploits into stablecoins together with USDT and USDC between 2020 and 2023.

Circle’s Delayed Response

ZachXBT’s accusations have sparked a firestorm in opposition to Circle, notably aimed toward its CEO, Jeremy Allaire. The corporate’s critics are saying that Circle has hardly cared for the integrity of crypto ecosystem, and that revenue appears to be taking on more room within the firm’s lexicon.

“They fake in public that it’s the compliant stablecoin meant to assist shield the ecosystem however is in actuality not precisely true,” ZachXBT commented. He famous that Circle, with a large employees, lacks an incident response crew to deal with DeFi hack or exploit-generated issues.

This criticism comes at a time when discussions about stablecoin regulation and anti-money laundering efforts are intensifying. The crypto house is rising much more nervous about stablecoins after they join with state-sponsored hacking outfits similar to Lazarus.

The Larger Image

The Lazarus Group has allegedly stolen $3 billion from the digital foreign money business in lots of high-profile assaults. These stolen funds might gas the North Korea regime-backed hacking group’s weapons growth.

Featured picture from Pexels, chart from TradingView