Though Bitcoin current value plunge has despatched a number of Altcoins on a free fall, with declines starting from 30% to 70%, there seems to be a beacon of hope set to shine by the murk.

The current Bitcoin Halving in April is what the altcoin market must get better and surge past its highest ranges.

Associated Studying

Bitcoin Halving: A Gateway to Altcoin Prosperity?

Bitcoin normally undergoes a Halving each 4 years, and this main occasion halves the block reward for miners in half. This fall in provide has usually triggered a bullish rally not just for Bitcoin but additionally for the altcoin market.

Crypto analyst Smart Recommendation elaborates that following every Bitcoin halving, there’s a pronounced potential for altcoins to surge. The analyst notably famous:

I do know when altcoin season will occur. And I’ll present you it… ‘Halving’ All of it will depend on it […] When halving occurs, after 1–1.5 years, the BTC ATH come And close to that, ETH and different altcoins increase.

Traditionally, this Halving interval has seen an explosion of consideration for altcoins, driving their costs greater as a result of shortage considerations from Bitcoin following this occasion.

For instance, within the earlier Bitcoin Halving on November 9, 2021, main altcoins, together with — Ethereum (ETH) and Solana (SOL), Polkadot. (DOT), Avalanche (AVAX) all recorded a brand new all-time excessive.

For context, ETH peaked at $4,800 on November 10, SOL got here in too with its new peak at $250 5 days earlier as revealed by Smart Recommendation, whereas DOT’s peak at $55 occurred on the 4th of that month, and AVAX peak at $144 occurred later that month on the twenty first.

How Does The Halving Factors To Alts Season Now?

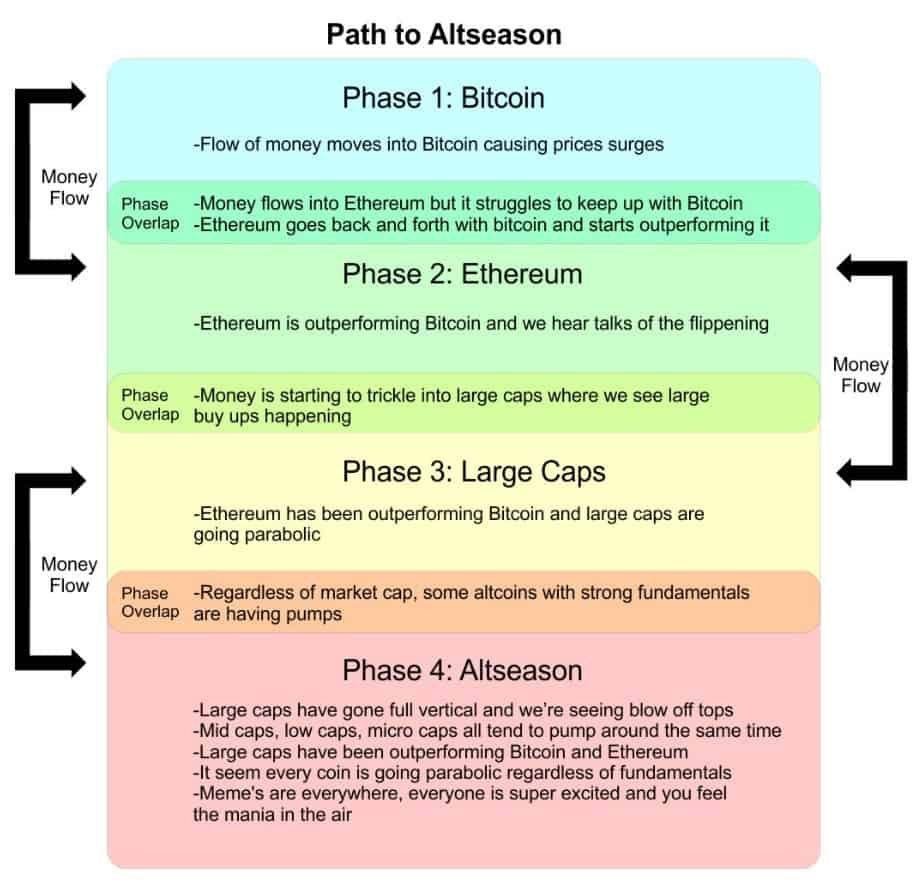

As Smart Recommendation’ put up suggests, such patterns underscore a recurrent theme: post-halving, cash flows from Bitcoin into altcoins, considerably buoying their market positions.

The analyst defined:

The extra they purchase, the upper the value goes. And it makes buyers worthwhile. They promote part of it and ship to Ethereum and different tokens. The market cap of those are manner decrease, so even the influx of $100 million could make an enormous change (a month earlier than the ATH, Bitcoin MC was in 2.5 instances bigger than Ethereum.) That’s why Solana and Polkadot’s ATH was 4-5 days sooner. Then cash goes to even smaller Alts. They usually begin to overperform huge ones. The smaller they have been, the larger the expansion was.

Notably, this shift is usually mirrored in Bitcoin’s dominance index—a metric that measures Bitcoin’s market capitalization relative to the entire market cap of all cryptocurrencies. As noticed post-halving, a decline on this index alerts a rising curiosity in altcoins.

Associated Studying

Bitcoin dominance is now at 54.60%, a slight lower from above 55%. Earlier this month, based on TradingView. Notably, the truth that the index continues to be considerably excessive, because it nonetheless stands above 50%, means that the market nonetheless favors BTC.

Nonetheless, the current lower may very well be the early indicators of an rising altcoin season. Analysts at Glassnode make an analogous level, linking current market circumstances with these in late 2020 when smaller shares and riskier belongings boomed, pointing in the direction of an impending altcoin season.

Rotation coming?

Yesterday, we noticed how #Nasdaq declined >2% – whereas #IWM rallied >3%.

This can be a clear indication of Rotation. The transfer to riskier belongings.

Will we additionally see that is #BTC and #Alts?

Effectively – in November 2020, we had a day similar to yesterday. IWM soared and… pic.twitter.com/WG9pooRxh1

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) July 12, 2024

Featured picture created with DALL-E, Chart from TradingView