“Ponzi scheme” has grow to be a byword for all method of monetary frauds and financial scams. When a fast six month collapse erased $2T (trillion) from crypto market capitalization in 2022, mainstream media shops have been fast to once more label cryptocurrencies, together with Bitcoin, Ponzi schemes.

Writing within the Chinese language Individuals’s Each day on-line version, Shan Zhiguang and He Yifan, representing the Chinese language Blockchain-based Providers Community (BSN), claimed:

Ever since Satoshi Nakamoto launched “Bitcoin: A Peer-to-Peer Digital Money System” in 2008, resulting in the official beginning of Bitcoin, the talk surrounding digital foreign money (Cryptocurrency) has by no means stopped for a second. [. . .] In its essence, the creator believes that digital foreign money is undoubtedly the biggest Ponzi scheme in human historical past.

Can Bitcoin be legitimately described as a Ponzi scheme? In that case, is it actually the biggest Ponzi scheme in historical past? Within the quickly growing world of tokenised property and digital currencies, the reply just isn’t as simple as you would possibly suppose. Actually, we’re confronted with a Bitcoin paradox.

The Origin of “Ponzi Schemes”

The Dictionary of Idiomatic English Phrases, revealed in 1891, claims that the etymological root of the the phrase “rob Peter to pay Paul,” that means to take what rightfully belongs to at least one individual to pay one other, is based in English folklore:

In 1540 the abbey church of St. Peter’s, Westminster, was superior to the dignity of a cathedral by letters patent; however ten years later it was joined to the diocese of London once more, and lots of of its estates appropriated to the repairs of St. Paul’s Cathedral.

There may be some dispute and proof suggesting “rob Peter to pay Paul” was in widespread utilization earlier than the sixteenth century. Later dictionary definitions specify that the phrase means “transferring cash from one group of individuals or place to a different, reasonably than offering extra cash.”

If we apply this to financial institution deposits, that are financial institution liabilities, then financial institution borrowing represents a variation of the method. We might rephrase it “use the debt owed to Peter to lend to Paul.” If we then take into account a fractional reserve banking system, and the probability that Paul’ cash will even be banked, then the entire deposit, lending and debt creation process—we name it the fiat financial system—starts to look distinctly fishy.

The thought of taking cash from some to pay others, has enabled many frauds and scams over the centuries. If the possible victims might be inspired to forgo pecuniary warning, then the fraudsters are on to a winner. Offering their fraud is not uncovered and they do not get caught.

Sarah Howe opened the Girls’ Deposit Firm in 1879. Working out of Boston, Howe provided her completely feminine clientele an attractive 8% month-to-month compound curiosity, promising to return $96 revenue on an preliminary $100 deposit within the first yr.

In a extremely misogynistic society, the place girls’s entry to finance and banking was restricted, Howe pitched her banking enterprise by interesting to girls’s sense of injustice. Claiming efficient charity standing, she instructed unsuspecting depositors that she was bankrolled by rich Quakers and their deposits have been protected. None of this was true.

Nobody was overlaying Howe’s operation. She was paying dividends to early buyers straight from the deposits she had taken from her different prospects. Howe’s fraud was uncovered and many of the girls who believed her, and within the trigger she claimed to assist, both misplaced their financial savings or a substantial proportion of them.

Howe served a 3 yr sentence and, upon her launch, embarked upon virtually the identical rip-off once more earlier than being imprisoned a second time. Howe’s favoured fraud would later grow to be referred to as a “Ponzi scheme.”

The Ponzi Scheme Takes Form

Lower than 20 years after Howe’s downfall, in 1898, William Miller, who grew to become recognized to many as “520% Miller,” began an funding scheme that promised buyers an enormous share return on their preliminary deposit. Aged simply 21, by all accounts, Miller was a poverty stricken workplace clerk with a younger household to feed. Having failed miserably in his white collar profession and with no notable blue collar expertise, Miller turned to the one factor he thought he might earn a living from: finance.

Miller repeatedly frequented “bucket outlets” the place these on decrease incomes would successfully wager on exercise within the inventory and commodity markets. Whereas, in actuality, no shares or commodities have been exchanged, as a “bucketeer,” Miller studied market kind like racing fans research horses. Miller was hopeless at this too and repeatedly misplaced his meagre earnings within the bucket outlets.

Miller by some means ingratiated himself among the many flock of the Christian Endeavor Society of the Tompkins Avenue Congregational Church. He first satisfied Oscar Bergstrom and two different churchgoers to speculate, what was then, the not inconsiderable quantity of $10 every into his insane monetary proposition. Promising them a ten% weekly dividend—an annual return of 520%—Miller satisfied his victims that he was such an astute investor, he couldn’t solely indemnify their preliminary funding however present them simple riches in return.

In the event that they reinvested their weekly dividend, Miller was providing them compound curiosity that might in the end present a windfall of $1,420, for his or her preliminary $10 deposit, within the first yr. Anybody who understood both markets or finance would have shortly realised this was a fairly ludicrous proposal. It appears Miller preyed upon folks with a really restricted grasp of finance. That is widespread characteristic of almost all Ponzi schemes.

Miller’s scheme took off as a result of he seemingly delivered. His early depositors made the returns he promised. Inside months, Miller’s magic cash making machine had grow to be the speak of Brooklyn, then New York and shortly the complete United States. Naming his rip-off “the Franklin Syndicate,” the cash poured in from throughout the nation.

Sadly, for many of his buyers, it was all a ruse. Miller was paying dividends and money outs from the cash he had accrued from each different investor. His gambit was to hedge that not all of his buyers would money out on the similar time. Whereas they did not, offering withdrawals remained comparatively low, he might cowl the funds. You could have noticed that Miller’s scheme was not dissimilar to fractional reserve banking on this regard.

Whereas the Syndicate made some investments, there was no underlying portfolio that might even remotely cowl any sort of run on Miller’s operation. His complete scheme was primarily based upon perpetual and important deposit development. A decelerate of incoming buyers would go away Miller with an unsolvable liquidity disaster. The Franklin Syndicate was a fraud.

When this was uncovered within the press, Miller fled to Canada earlier than being arrested and extradited again to the US. Regardless of a protracted authorized dispute, involving profitable appeals, which have been then reversed, and a dizzying array of accusation and counter-accusation among the many rip-off’s protagonists, Miller, who was additionally nicknamed the “the Boy Napoleon of Finance,” was nonetheless imprisoned in Sing Sing jail. Upon his launch, Miller went straight and garnered yet one more moniker: “Sincere Invoice.”

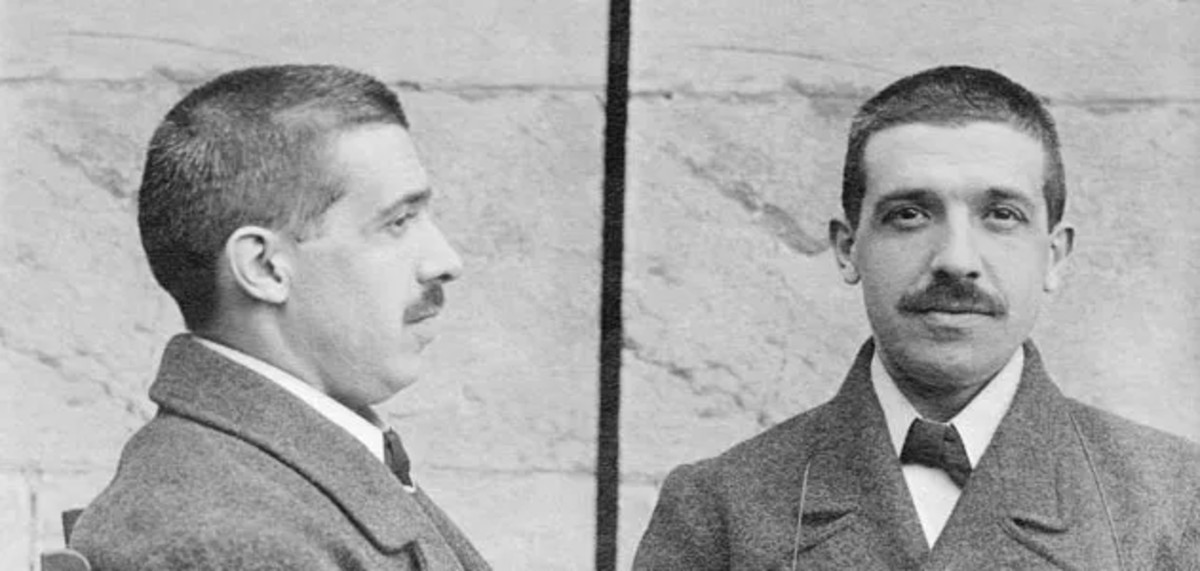

Whereas it appears extremely doubtless, it is not completely clear if Carlo Pietro Ponzi, higher referred to as Charles Ponzi, was conversant in both Howe’s or Miller’s scams. What might be stated is that he emulated their mannequin of monetary fraud and took it to new heights. Consequently, he’ll ceaselessly be remembered for his “Ponzi scheme.”

Born in Lugo, Italy, in 1882, Ponzi arrived virtually penniless in Boston in 1903. By the point he embarked upon his Ponzi scheme, he had already been convicted for fraud, in Canada and, what we’d right this moment name, “folks smuggling” within the US.

As a younger man in Italy, Ponzi labored for the postal service. This maybe influenced his resolution to initially launch a wholly authorized arbitrage enterprise.

Ponzi reportedly acquired a letter from Spain with an “worldwide reply coupon” (IRC) included. Ponzi famous that the IRC worth paid in Spain was significantly lower than the face worth of the US stamp he might buy with the it. He set about exploiting the worldwide worth distinction for professional revenue by promoting international IRC bought US stamps to US prospects. Ponzi established “the Securities Alternate Firm” for his enterprise.

Whereas theoretically viable, Ponzi’s arbitrage revenue margins relied upon him undercutting the US submit workplace. His potential prospects might purchase the stamps virtually in all places and had no inducement to purchase from him in any other case.

His margins have been additional restricted by unfavourable fluctuation in trade charges, promoting prices, supply and provide prices and he required important commerce quantity to offer himself with any sort of substantial revenue. In different phrases, if he was going to earn a residing from his concept, onerous work was crucial. Evidently, this wasn’t one thing Ponzi was too eager on and his ambitions went far past working a small enterprise.

In contrast to Miller, who merely claimed he was a monetary wizard, Ponzi recognised that he might lend some authenticity to his fraud by basing it upon, what no less than gave the impression to be, a believable enterprise concept. Ponzi determined to make up some wild, unfounded claims in regards to the success of his worldwide arbitrage operation and centered upon attracting as many buyers as doable.

Claiming the necessity to preserve aggressive benefit, Ponzi stated he could not disclose the exact particulars of his technique. A broad define of his marketing strategy was enough to persuade a throng of buyers. He provided them a 50% revenue, first inside 90 days after which later, to extend the tempo of incoming deposits, inside 45 days.

Ponzi’s scheme was, in all different respects, an identical to Miller’s and Howe’s. Funds have been made as promised to early buyers from the deposits hoovered up from all of the others. Wholesome dividends paid to a minority satisfied the bulk to reinvest and by no means money out, thus enabling Ponzi to quickly increase. Taking the majority of his beneficial properties for himself, Ponzi knew the place the true cash lay and so sought to purchase a controlling curiosity in a financial institution.

Ponzi focused the Hanover Belief financial institution which had turned down his $2000 enterprise mortgage request solely a yr earlier. As soon as the fraud was lastly reported by the press, in the summertime of 1920, his “Ponzi scheme” collapsed briefly order. Charles Ponzi’s publicity elicited a terminal run on Hanover Belief which additionally held a $125,000 deposit from the Commonwealth of Massachusetts, resulting in the resignation of State Treasurer Fred Burrell.

Ponzi’s inexorable march in direction of one other jail sentence most likely wasn’t helped when “520% Miller” was quoted by the New York Occasions, simply days earlier than the entire implosion of Ponzi’s firm, saying:

I could also be reasonably dense, however I can’t perceive how Ponzi made a lot cash in so quick a time.

Ponzi confronted two federal indictments on a complete of 86 counts of mail fraud. He served three and half years of 5 yr time period earlier than being re-indicted for larceny by Massachusetts state prosecutors shortly after his launch. Ponzi sued, claiming this was a breach of the plea discount he had made with federal prosecutors. The efficient “double jeopardy” argumentation went all the way in which to the Supreme Courtroom and Ponzi misplaced. In between his durations of subsequent incarceration, there have been appeals, stints on the run, assumed faux identities, extra Ponzi schemes and different frauds. Finally Ponzi was deported again to Italy in 1934.

Ponzi was a flamboyant character who, regardless of his crimes, loved some remaining fashionable assist which dwindled as his authorized disputes dragged on. However his Ponzi schemes and frauds weren’t victimless. Many individuals, particularly within the Boston Italian neighborhood, misplaced their life financial savings to Ponzi. Whereas accounts differ, the entire estimated losses of the primary named “Ponzi scheme” have been between $15M – $20M. Equal to between $231M – £308M right this moment.

Ponzi’s spouse, Rose Gnecco, stayed loyal to him all through his undoing. When he was lastly deported to Italy, Ponzi had reportedly swindled Rose and her household out of $16,000.

Allegedly the Largest Ponzi Scheme In Historical past

In 2021, claiming Bitcoin was a Ponzi, the Brazilian laptop scientist, Jorge Stolfi, outlined the 5 main traits of a Ponzi scheme.

Individuals make investments right into a Ponzi scheme primarily as a result of they count on good earnings, and:

- that expectation is sustained by such earnings being paid to those that select to money out. Nevertheless,

- there isn’t a exterior income for these payoffs. As an alternative,

- the payoffs come completely from new funding cash, whereas

- the operators take away a big portion of this cash.

Ponzi schemes are all the time too good to be true. A modicum of due diligence ought to deter these cautious sufficient to train some. No matter Stolfi’s arguments about Bitcoin—we’ll study them in additional element shortly—in order for a Ponzi scheme to succeed, along with a level of monetary gullibility, the investor falls prey to the fraudster as a result of they “count on good earnings.”

So whereas there are victims, the people who lose their shirts aren’t completely “innocent.” They exhibit what former US Federal Reserve Chairman Alan Greenspan known as “irrational exuberance.” Clearly, this by no means exonerates the fraudster.

That did not cease Bernie Madoff—perhaps essentially the most infamous exponent of the Ponzi scheme aside from Ponzi himself—from levelling the accusation of greed at his victims. In March 2009, Madoff pleaded responsible to 11 federal prices, together with cash laundering and securities fraud, and was sentenced to 150 years. He died in jail in 2021, aged 82.

Following his conviction, Madoff’s household suffered a string of tragedies. In 2010, Bernie’s son Mark dedicated suicide. In 2014 his different son, Andrew, died from a really uncommon type of most cancers and, in 2022, Bernie’s aged sister, Sondra Wiener, and her husband Marvin each died in an obvious murder-suicide.

It’s steadily acknowledged that Madoff operated the biggest Ponzi scheme in historical past. For purpose’s we’re about to debate, that declare is doubtful.

Madoff served as Nasdaq’s chairman in 1990, 1991 and 1993, and was arrested in 2008. By then his Ponzi scheme had been working for no less than 20 years and prosecutors estimated the size of his fraud, primarily based upon 4,800 recognized shopper accounts, to be $65B. The whole misplaced precept was lastly estimated at $19.4B. Unusually, for a collapsed Ponzi Scheme, almost $15B of the precept has been recovered for some buyers.

The US Securities Investor Safety Company (SIPC) protects buyers in opposition to losses to fraud, however provided that they unwittingly invested straight within the rip-off. Sadly, 80% Madoff’s Ponzi scheme victims got here from “feeder funds” or funding swimming pools and have been deemed third events. As such, most of the comparatively small buyers weren’t eligible for SIPC safety. Bigger depositors, comparable to institutional buyers, have been comparatively properly protected and have retrieved most of their funding, although not their earnings.

Those that withdrew greater than they put in—net winners—were required to repay the distinction. This left the overwhelming majority of Madoff’s small-time victims scrabbling to file civil motion lawsuits to attempt to recoup misplaced financial savings. Typically they have been making an attempt to entry the safety fund repaid to the US State by the very swimming pools they’d invested via. The massive feeder funds themselves have been largely lined by the SIPC.

Whereas Madoff maintained he was solely accountable, clearly such a monumental Ponzi scheme concerned many gamers. In subsequent years, just a few confronted punishment. For instance, Frank DiPascali, Madoff’s chief monetary officer and Madoff’s secretary, Annette Bongiorno, alongside his operations supervisor, Daniel Bonventre and accounts manger, Joann Crupi, all served time after associated prosecutions. Others have been extra lucky, financially talking.

The investor Jeffrey Picower had grabbed an estimated $7.2B from the Ponzi scheme. As with so many others carefully associated to Madoff’ fraud, he died unexpectedly shortly after Madoff’s conviction. Whereas his widow was subsequently compelled to forfeit the cash, Picower actually benefited in his personal lifetime.

Stanley Chais funnelled his purchasers investments into the Ponzi scheme for many years. Taking an estimated $1B in earnings, the celebrated Israeli philanthropist lastly settled a “revenue” reimbursement of $277M.

Norman Levy had been investing within the Ponzi scheme because the Seventies. His property settled for $220M in 2010. Given the prolonged interval of his involvement, this additionally looks like a reasonably beneficial consequence.

Madoff started his scheme with seed cash from clothes entrepreneur Carl Shapiro. Shapiro had been investing with Madoff for 40 years and made a $250M funding solely weeks earlier than the rip-off detonated. Shapiro paid again $625M in complete. Picower, Chais, Levy and Shapiro ultimately grew to become referred to as “the Large 4.” Comparatively talking, their “losses,” if they’d any, appeared extra bearable than most.

Madoff based the Wall Road agency Bernard L. Madoff Funding Securities LLC (BMIS) in 1960. Like Ponzi, Madoff’s distinctive promoting proposition (USP) did not seem too outlandish. He went additional than different Ponzi operators to scrupulously preserve plausibility. He gave his rip-off an air of exclusivity, initially declining would-be buyers. He additionally cultivated his picture as a reliable philanthropist, donating generously to worthy causes and did not supply clearly ridiculous returns.

Claiming that he used a split-strike conversion, or collar, funding technique, Madoff satisfied potential purchasers that by buying each out-of-the-money (OTM) ‘put’ choices and promoting ‘name’ choices (lined calls) he might guarantee a gentle, low threat 20% annual return on funding (ROI).

If the inventory worth in Madoff’s portfolio dropped, the bought put possibility, forcing a sale on the subsequent above market strike worth, would mitigate any losses. If the value rose above the lined name strike worth, Madoff’s name possibility consumers would train their proper to purchase his shares.

Whereas this may restrict earnings to the strike worth of the lined name, the premium from promoting the decision choices would additionally fund the acquisition price of the places. Even for these with some grasp of market finance, all of it appeared so plausible.

SEC Disinterest

In contrast to Howe, Miller and Ponzi, Madoff didn’t promise immediate riches or make conspicuously exorbitant claims. This undoubtedly contributed to the longevity of his grift, nevertheless it wasn’t the one purpose he sustained the so-called “largest Ponzi scheme in historical past” for greater than 20 years.

Sixteen years earlier than Madoff’s flimflam was uncovered, the Wall Road Journal (WSJ) reported the US Securities and Alternate Fee’s (SEC’s) investigation of a Florida funding pool, run by the accountants Frank J. Avellino and Michael S. Bienes. The pair have been suspected of swindling $440 million out of the Florida neighborhood via their A&B buying and selling enterprise.

However when the courtroom appointed auditors checked A&B’s books, the cash, no less than, was all in place. Technically, the pair did not look like defrauding anybody. Frank and Michael have been taking a profit—effectively a considerable dealing with fee—after outsourcing their funding technique to a cash supervisor. That dealer was Bernie Madoff.

Madoff had pioneered digital buying and selling, calling it “synthetic intelligence.” In 1992, because the SEC have been investigating A&B, BMIS might execute trades sooner and cheaper than anybody else. Consequently, BMIS’ each day commerce quantity was round $740M, representing 9% of all exercise on the New York Inventory trade. Regardless of a few years through the Eighties, when market volatility left cash mangers struggling to even match the turbulent efficiency of the S&P 500 index, BMIS have been seemingly all the time capable of beat it by some margin.

When the WSJ quizzed Madoff about A&B’s pool, he revealed that he had been working his split-strike and related methods, comparable to convertible arbitrage, because the late 1970’s. In hindsight, suggesting one thing nearer to a 40 yr Ponzi scheme.

A&B’s mistake was not registering the trades with the SEC. Had they executed so, then Madoff would essentially have been listed as their dealer. The SEC accused Frank and Michael of working “an unregistered funding firm [that] engaged within the illegal sale of unregistered securities.” Talking about A&B, Madoff reportedly stated “he did not know the cash he was managing had been raised illegally.” Everybody appeared blissful to simply accept him at his phrase.

For some purpose, regardless of a prolonged investigation and courtroom orders compelling the A&B to return buyers’ cash, neither A&B’s legal professionals nor the SEC named Madoff. It was the WSJ that reported the id of A&B’s mysterious cash man. Apparently, the revelation did not even vaguely pique the SEC’s curiosity in BMIS.

Mockingly—perhaps having learn the WSJ article—following the closure of A&B, and now realizing who the duo’s dealer was, almost all of A&B’s purchasers reinvested their cash in BMIS’ split-strike wheeze. As did Frank Avellino and Michael Bienes.

Madoff’s Ponzi scheme had a greater USP than any earlier than it. It was a complete charade however. Madoff was following the Ponzi technique exactly.

He Madoff was merely depositing his buyers cash in his account held by Chase Manhattan Financial institution—later merging into JP Morgan Chase & Co—and paying shopper redemptions from these funds. The impression of the Ponzi scheme’s collapse was devastating for some, however not everybody. At its peak, Madoff’s account held $5.5B.

The split-strike conversion is a superbly professional method to funding. Additionally it is a conservative, long run funding technique unlikely to ship an annual 20% ROI. Within the 1992 WSJ article, the journalists questioned Madoff in regards to the obvious resounding success of BMIS:

[Madoff] insists the returns have been actually nothing particular, on condition that the Normal & Poor’s 500-stock index generated a mean annual return of 16.3% between November 1982 and November 1992. “I might be shocked if anyone thought that matching the S&P over 10 years was something excellent,” he says.

This was mainly misinformation. Madoff’s claimed split-strike technique did not clarify how he achieved such startling outcomes. There is no such thing as a proof that the regulators, the supposed specialists in monetary fraud, have been in in the least sceptical. Quite the opposite, they gave the impression to be going to some lengths to keep away from investigating Madoff.

SEC Failure?

The 2008 monetary crash was the primary contributory issue for the collapse of BMIS. Like all Ponzi schemes, perpetual development was a prerequisite. When depositors in search of safer havens cashed out, Madoff’s reportedly confronted a $7B liquidity disaster with no hope of resolving it.

Madoff confessed to his sons, who have been allegedly shocked by the invention, they usually turned their very own father in after looking for authorized recommendation. Madoff took a plea deal, supposedly to spare his household additional ache. Sadly, that did not pan out both.

The SEC did not take any critical curiosity in BMIS till 2008. The 2009 Workplace of Inspector Common (OIG) report into the string of SEC “failures” to analyze discovered nothing untoward.

The truth that SEC Assistant Director Eric Swanson was carefully linked to the Madoff family—in a relationship with Bernie’s niece—was not deemed suspicious. Shana Madoff simply occurred to be Madoff’s chief compliance officer. Having met in 2003, she and Swanson married in 2007.

Going again to the A&B investigation, between 1992 and 2008, the SEC acquired six “substantive complaints” and had learn two media articles from “respected publications,”—the WSJ’s piece being one in all them—that raised some “purple flags” with regard to “Madoff’s unusually constant returns.”

Figuring out that, all through the sixteen yr interval of “purple flags,” the SEC “by no means took the mandatory and fundamental steps to find out if Madoff was misrepresenting his buying and selling” and that “the SEC might have uncovered the Ponzi scheme properly earlier than Madoff confessed,” the OIG discovered no proof of any wrongdoing.

Apparently, it was all as a result of SEC trusting no matter Madoff instructed them. The involvement of too many “inexperienced personnel”—who have been presumably clueless—was reportedly an issue. A normal lack of planning and, as is monotonously regular for this sort of inner investigation, a “systematic breakdown” for which no “senior-level officers” held any form of accountability, all contributed to SEC alleged “failure”.

Remarkably, the OIG acknowledged:

The SEC examiners and investigator failed to know the complexities of Madoff’s buying and selling and the significance of verifying his returns with unbiased third-parties.

Which reasonably begs the query what the SEC supposedly does if it will probably’t “perceive the complexities” of monetary market buying and selling. However are there another explanation why the SEC could have been averse to upending BMIS?

A Very Helpful Ponzi Scheme

BMIS was a significant third market buying and selling supplier. It was appearing as a “market maker,” offering liquidity to finance the over-the-counter (OTC) commerce in securities between massive institutional buyers. Whereas these securities are “exchange-listed” they aren’t traded via the massive inventory exchanges, such because the New York Inventory Alternate.

The third market offers a stage of anonymity and excludes some public info usually required for buying and selling on the foremost exchanges. It’s the place huge institutional buyers go to to conduct fast enterprise, sometimes shopping for and promoting massive blocks of firm shares. They use the third marketplace for their very own profit, reasonably than appearing on a purchasers behalf.

BMIS was one of many largest, many say “the” largest, market maker on Wall Road. As such, BMIS would possibly, for instance, purchase a big block of shares off a significant investor for money. Thus enabling massive institutional buyers to shortly liquidate important inventory holdings, without having to finalise a purchaser.

As famous by the Dubai bases funding “incubator,” FasterCapital:

Third market makers play an important position in enhancing market liquidity by offering a relentless stream of purchase and promote orders. Their presence ensures that there’s all the time a counterparty accessible for merchants, whatever the prevailing market circumstances. [. . .] By doing so, they assist stabilize the market and be sure that buying and selling can proceed even in turbulent instances.

Madoff’s Ponzi Scheme was an important supply of liquidity for world monetary markets.

Apparently, this had nothing to do with the SEC’s peculiar Madoff blind-spot. We’re requested to imagine that US regulators have been oblivious to an infinite Ponzi scheme run by one in all Wall Streets main companies for greater than 20 years. BMIS key position in shoring up unsteady world markets had nothing to do with it, or so we’re instructed.

When all of it got here crashing down, Bernie Madoff’s $7B liquidity entice was nothing in contrast the outlet the remainder of the monetary system discovered itself in.

Genuinely The Largest Ponzi Schemes In Historical past

When researchers from the College of Louisiana at Lafayette regarded into Madoff’s Ponzi scheme checking account, they reported:

Assuming that the deposits returned the financial institution’s internet curiosity margin and grew at a random geometric charge, this paper estimates that JP Morgan Chase generated $435 million in after-tax earnings from this very massive account over the course of sixteen years.

Finally, JP Morgan Chase & Co (JPMC) agreed to pay the US authorities a $2.6B settlement—for a deferred prosecution agreement—and admitted “negligence.” Subsequently, JPMC have been ready to withstand a lawsuit from the “internet winners” of Madoff’s schemes who accused JP Morgan of direct complicity.

The Choose cited JPMC’s admitted negligence in his ruling, observing that negligence didn’t quantity to fraud. The buyers not lined by the SPIC misplaced once more. Like everybody else with oversight of Madoff’s actions, JPMC maintained it did not have a clue, though conceded it might have been extra diligent.

For main industrial banks like JPMC $2.6B is not hen feed, however neither is it again breaking. Instantly, following the 2008 monetary crash, attributable to the wild hypothesis within the monetary derivatives market, the US authorities agreed to inject $250B of capital into the industrial banks. This was along with the $700B buy of the banks junk property and a senior debt underwriting package deal price $1.5T (trillion), together with $500B deposit assurance for enterprise accounts. This amounted to an preliminary $2.45T financial institution rescue mission within the US alone.

We’ll keep centered on the US right here, however we should not overlook that what occurred within the US was emulated in many countries. The story behind the worldwide 2007/8 crash is well-known however price briefly reiterating.

Mortgage Backed Securities (MBS) are securities traded within the derivatives market. An MBS is a fixed-income safety primarily based upon the curiosity funds due on the pooled mortgages it accommodates. The underlying asset of an MBS is the accrued bundle of mortgage agreements.

The early to mid-2000s noticed fast property worth rises within the US. Mixed with plummeting Fed’ Fund rates of interest, that stayed comparatively low till mid decade, the industrial banks have been throwing cash at anybody who claimed they might afford to make the repayments. This included lending to the subprime market catering for folks with low credit score scores. Typically these have been curiosity solely mortgages and never simply family mortgages both. Colaterall loans on industrial, industrial and agricultural property have been usually pooled with residential mortgages in MBS.

Subprime lending to accommodate consumers, setting increased mortgage charges, was notably profitable. If the debtors defaulted, the banks might repossess, make the household homeless, and sit on tidy property portfolios. So long as the housing market remained buoyant.

The minimally regulated funding banks have been working hedge funds, buying and selling MBS and different securities within the derivatives markets. Thus, as industrial banks additionally operated funding arms, they have been growing demand for their very own mortgage lending. They have been inflating the housing bubble and stimulating their very own excessive threat, subprime lending.

The scores companies, who’ve a battle of curiosity as a result of they’re paid by the banks, gave almost all of the MBS triple ‘A’ (AAA) scores, together with MBS full of subprime mortgages. Consequently institutional buyers have been desperate to commerce the supposedly protected “residential mortgage backed securities” (RMBS).

This commerce was once more fuelled by the industrial banks who continued to imprudently bathe low cost cash on buyers enthusiastically speculating with MBS. Commerce was executed over-the-counter (OTC), ably assisted by, amongst others, Bernie Madoff, who provided institutional buyers extra liquidity every time they wished to pounce on an MBS alternative.

To complicate issues, different monetary derivatives, primarily based solely or largely upon MBS, comparable to Collateralized Mortgage Obligations (CMOs) and Collateralized Debt Obligations (CDOs), have been additionally being liberally traded.

Stoking issues additional, the industrial banks had been promoting Credit score Default Swaps (CDS), to mitigate potential MBS dangers, for years. CDS consumers usually pay a daily premium to the vendor in trade for a purchase order settlement of the safety and curiosity due, if a “credit score occasion” happens. A “credit score occasion” for an MBS could be triggered if the mortgage holders defaulted.

What’s extra, the CDS are additionally derivatives that may be traded. Many institutional MBS buyers purchased CDS from industrial banks, or different sellers, then resold the CDS to different buyers for marginal revenue within the derivatives market. The CDS mannequin of insurance coverage cowl for MBS hypothesis inspired the scores companies to subject AAAs on MBS with very restricted scrutiny of the underlying property; the subprime mortgages.

So immense was subsequent spinoff buying and selling in CDS, by 2007, CDS constituted the biggest single asset pool on the planet. The estimated world CDS pool worth was $62.2T. What occurred subsequent would wipe $35.9T of CDS “worth” off the monetary markets in two years.

Beginning in 2004, the Fed Fund charge started to rise. This corresponded with the tip of many subprime debtors preliminary mortgage agreements. As they regarded to remortgage they could not meet the brand new charges and mortgage delinquency, defaults, repossessions and family debt rose sharply. The US housing bubble popped, leading to widespread financial ache and years of austerity.

As with the demise of Madoff’s Ponzi scheme, some buyers fared markedly higher than others. As regular, it was the small time depositors, owners and the general public who bore the brunt of the monetary distress.

In all probability, the precursor to a world monetary collapse wasn’t as unhealthy as many feared. Subprime mortgages have been the underlying property in a comparatively small share of MBS. The actual drawback, as soon as once more, was the “complexity” within the derivatives market.

The 2011 US authorities Monetary Disaster Inquiry Report famous:

OTC derivatives quickly spiralled uncontrolled and out of sight, rising to $673T in notional quantity. [. . .] OTC derivatives contributed to the disaster in three important methods. First, one kind of spinoff—credit score default swaps (CDS)—fuelled the mortgage securitization pipeline. CDS have been bought to buyers to guard in opposition to the default or decline in worth of mortgage-related securities backed by dangerous loans. [. . .] [W]hen the housing bubble popped and disaster adopted, derivatives have been within the middle of the storm. [. . .] [M]illions of derivatives contracts of every kind between systemically essential monetary establishments—unseen and unknown on this unregulated market—added to uncertainty and escalated panic.

When the music stopped, the interweaving community of MBS, CMOs, CDOs and CBS, mixed with the relative anonymity of OTC buying and selling, left buyers, banks and regulators alike, unable to determine the place the publicity lay. Nobody might work out who was holding junk bonds and who wasn’t. Consequently, as demand merely stopped, the funding banks have been left holding mountains of poisonous property.

Whereas the rationale to panic was maybe not as acute as assumed, panic ensued nonetheless. The worldwide derivatives market is sort of completely dependent upon investor confidence. With out it, no matter their notional worth, the multitude of MBS associated monetary devices have been comparatively nugatory. Taking the knock-on monetary impacts into consideration, the ultimate price of all this, simply to the US economic system, was virtually incalculable.

In response to Harvard Enterprise Assessment, in 2018 an inexpensive complete loss estimate was someplace within the area of $4.6T. As conservatively estimated by the Federal Reserve, this successfully meant that each US citizen paid $70,000 into the derivatives rip-off. The price of the financial institution bailouts alone pressured each US taxpaying citizen to grow to be an “investor,” whether or not they wished to be one or not.

So let’s evaluation how a really gargantuan Ponzi scheme operates.

If executed with any aplomb, the USP appears believable. This attracts a large number of buyers who suppose they’re investing in an actual monetary plan. In actuality, the underlying property are junk and they’re truly receiving funds from everybody else “invested” within the scheme.

That’s precisely how the 2008, derivatives market monetary rip-off performed out. So no, Bernie Madoff’s Ponzi scheme wasn’t even near being “the biggest Ponzi scheme in historical past.” It was a bit participant within the colossal world monetary fraud that dwarfed it.

However this nonetheless wasn’t the biggest Ponzi scheme in historical past.

As famous within the 2011 Disaster report, in 2008 the notional quantity of “cash” invested in OTC derivatives was $673T. US GDP in 2008 was round $14.5T. World GDP in the identical yr was about $61T. How might something on the planet have a notional “financial” worth greater than ten instances bigger than the financial worth of the complete productive economic system of the Earth?

The reply is that the worldwide fiat foreign money financial system is the mom of all Ponzi schemes.

All of us, put money into it with our labour. However there isn’t a intrinsic worth underpinning that foreign money. Thus, its provide can increase with out restrict, making is seemingly doable to notionally worth a tranche of derivatives far past the worth of the complete world economic system.

By way of such mechanisms as inflation, the early buyers, those that first seize the issuance of latest “cash”—the industrial banks—cash out because of a switch of wealth from all of us, to them.

As demonstrated by Professor Richard Werner in his 2014 paper titled “Can Banks Individually Create Cash Out of Nothing,” banks create fiat foreign money from nowhere every time they make a mortgage.

Some will argue that fractional reserve banking limits this course of. The issue with that is that central banks create reserves in precisely the identical method. For instance, in accordance with the Financial institution of England (BoE), Quantitative Easing (QE)—which pushed the worldwide cash provide to actually climb off the charts—operates as follows:

Quantitative easing includes us creating digital cash [. . .] to purchase issues like authorities debt within the type of bonds […] By creating this ‘new’ cash, we purpose to spice up spending and funding within the economic system.

This new “digital cash” did not exist till the central financial institution made it seem with a wave of its monetary wand. Simply because the industrial banks conjure broad cash from nothing, the central banks create the identical “fairy mud”—as Werner known as it—when they magic reserves, or base cash, out of the ether.

The BoE provides that additionally they “use this new cash to purchase bonds from the non-public sector.” Imagining cash into existence concurrently creates reciprocal debt. The BoE offers an instance of how this mythological monetary system operates:

Suppose we purchase £1 million of presidency bonds [with fairy dust] from a pension fund. Instead of the bonds, the pension fund now has £1 million in cash. Somewhat than maintain on to this cash, it would make investments it in monetary property, comparable to shares, that give it the next return. And when demand for monetary property is excessive, with extra folks wanting to purchase them, the worth of those property will increase.

Asset “worth” actually elevated previous to the collapse of the 2008 world Ponzi scheme. Not solely was the assumed worth speculative, to the purpose of being baseless, the purchases have been made with “fairy mud.”

All of this manufactured debt and the earnings {that a} choose few glean from it, is in the end paid by us, the taxpayers. We’re the unwitting buyers. As savers, small companies and dealing households lose buying energy, family debt accrues. Aided by ever escalating nationwide debt ceilings, the institutional buyers and the banks, as business companions of presidency, simply maintain going.

There may be nothing “actual” in regards to the world financial system Ponzi scheme. Whereas provide and demand, and fundamental financial ideas like “worth,” nonetheless apply, the monetary system outstripped the “actual economic system” and headed off to Neverland half a century in the past.

Following the 2008 monetary crash—they largely caused—the industrial banks continued to plough their taxpayer underwritten fairy mud into the derivatives market. Producing ever extra nymph-fuelled debt for the true world economic system and hoovering up extra earnings alongside the way in which. Between Q3 2008 to Q3 2010, main US banks elevated their complete notional derivatives publicity from roughly $175T to just about $235T.

Nobody actually is aware of how huge the “notional” worth of the present derivatives market is. Some say greater than $1 quadrillion. The Financial institution for Worldwide Settlements (BIS) acknowledged:

The notional worth of excellent over-the-counter (OTC) derivatives rose to $632T at end-June 2022 [. . .]. The gross market worth of excellent OTC derivatives, summing optimistic and detrimental values, rose noticeably within the first half of 2022, to $18.3T.

In Ponzi scheme phrases, that is tantamount to saying the collapse of the derivatives market would go away a nominal debt-owed gap within the world economic system of $632T. The precept threat is $18.3T.

To be frank, exact calculations of the size of spinoff humorous cash hypothesis are considerably irrelevant. Suffice to say, there are monstrous sums sloshing round in excessive threat spinoff Ponzi schemes that may solely exist because of debt primarily based cash printing. Usury in different phrases.

If buyers lose confidence and attempt to money out of the derivatives market, the entire home of card will crash. It would take all the pieces with it, once more.

In fact, hedge fund earnings are additionally paid in magic cash, however that does not matter to the grifters. So long as all of us keep on believing the so-called “cash” is actual, we’ll proceed to traipse off to work to pay for all of it. Thereby, permitting the profiteers to transform their sparkles into actual property. Mansions, yachts, large tracts of farmland, weapons factories, gold and Bitcoin, for instance.

Bitcoin Is Not A Ponzi Scheme

Satoshi Nakamoto’s started work on Bitcoin in 2007, earlier than the worldwide monetary crash took form. That stated, to an important extent, whoever the pseudonymous Nakomoto could also be, they however provided a possible answer to the fiat financial Ponzi scheme. Shortly after the Bitcoin genesis block was mined, in 2009 Nakomoto wrote:

The foundation drawback with standard foreign money is all of the belief that is required to make it work. The central financial institution should be trusted to not debase the foreign money, however the historical past of fiat currencies is stuffed with breaches of that belief. Banks should be trusted to carry our cash and switch it electronically, however they lend it out in waves of credit score bubbles with barely a fraction in reserve. [. . .] With e-currency primarily based on cryptographic proof, with out the necessity to belief a 3rd occasion intermediary, cash might be safe and transactions easy.

The Cypherpunks had been engaged on the “monetary sovereignty” drawback for almost 20 years previous to the publication of Nakomoto’s white paper. They have been wrestling with advanced cryptographic issues like the way to independently timestamp transactions on an digital ledger and the way to overcome the issue of “double-spending”—using the identical unit of digital foreign money repeatedly—without reliance upon some third occasion verifying transactions. The Cypherpunks have been making an attempt to chop out the banks.

Constructing on the sooner work of Cypherpunks like David Chaum, Nakamoto’s elegant distributed ledger know-how (DLT) answer was really unprecedented: one thing new below the solar.

In 2009 Nakamoto wrote:

Bitcoin’s answer is to make use of a peer-to-peer community to verify for double-spending. In a nutshell, the community works like a distributed timestamp server, stamping the primary transaction to spend a coin. It takes benefit of the character of knowledge being simple to unfold stifle however onerous to stifle.

Although Nakamoto did not use the phrase “blockchain” that’s what was outlined within the white paper:

The answer we suggest begins with a timestamp server. A timestamp server works by taking a [cryptographic] hash of a block of things to be timestamped and extensively publishing the hash [. . .]. The timestamp proves that the info will need to have existed on the time, clearly, to be able to get into the hash. Every timestamp contains the earlier timestamp in its hash, forming a series, with every extra timestamp reinforcing those earlier than it.

Bitcoin is a peer-to-peer (p2p) digital foreign money issued and signed through cryptographic algorithms. Cryptocurrencies are separate and distinct from different types of “digital foreign money.” The community of nodes settle for proof-of-work (PoW) consensus guidelines to validate and broadcast transaction on the community. The nodes are extensively distributed, every carrying an entire report of the networks transaction historical past. They don’t require “permission” to validate PoW on the community (blockchain – DLT).

Bitcoin is a p2p cryptocurrency that operates on a decentralised, permissionless blockchain. This implies, it may be utilized by folks all over the world to make worldwide remittances with out the necessity of any third occasion, comparable to a financial institution or a cost service supplier. All they want is web entry.

If we take Bitcoin to be a functioning currency—a medium of trade for items and services—and if we additionally settle for Satoshi Nakamoto’s imaginative and prescient of decentralised peer-to-peer permissionless community ledger (permissionless blockchain), can Bitcoin legitimately be known as a Ponzi scheme?

Let’s revisit Jorge Stolfi’s Ponzi scheme definition.

You may put money into Bitcoin, anticipating good earnings, however solely of your intention is to commerce it and never use it as a foreign money. As a foreign money, there aren’t any commerce earnings to “money out.” You earn it and spend it as you’d with any medium of trade (foreign money).

One of many criticisms of Bitcoin, and different cryptocurrencies, is their valuation volatility, measured in fiat currencies such because the US greenback. Actually, in case you purchased sufficient Bitcoin in 2009 and cashed out right this moment you’d have made a placing above inflation “revenue.” However that each one relies upon upon the intrinsic “worth” of Bitcoin.

In a Ponzi scheme there isn’t a exterior income to cowl “payoffs.” However it is a moot level with regard to Bitcoin. Bitcoin does not want exterior sources as a result of it’s a foreign money with intrinsic worth and there aren’t any payoffs (until you’re buying and selling it).

Any payoffs merchants take are often paid in fiat foreign money. Whereas the traded Bitcoin wants a purchaser, no Bitcoin is definitely faraway from the p2p community (blockchain). To this extent there isn’t a “new funding cash” merely a switch of possession of the prevailing foreign money.

Worth fluctuation is a mirrored image of Bitcoins intrinsic worth. This can be altered, up or down, by dealer exercise however it isn’t a perform of Bitcoin. It’s a consequence of buying and selling Bitcoin as one would possibly on the Overseas foreign money exchanges (Foreign exchange). Merchants collect fiat fairy mud by buying and selling Bitcoin between themselves.

Nobody is taking massive parts of Bitcoin “away.” Bitcoin mining, utilizing computer systems to verifying PoW, is effort and time (work) paid in Bitcoin.

Bitcoin just isn’t a Ponzi scheme. It’s a foreign money. In contrast to fiat foreign money fairy mud, it isn’t created out of nothing. Actual work—Bitcoin mining—“earns” Bitcoin and provides it to the blockchain.

Satoshi established Bitcoin in 2008, the identical yr the worldwide monetary crash took maintain. Nakamoto restricted the entire most provide of Bitcoin to to 21M BTC. There may be numerous debate about why the 21M determine was set. Some say it’s a mathematical perform of the BTC protocol, others that the intention was to create shortage and thus render BTC a retailer of worth. Consequently folks generally discuss with it as “Bitcoin gold.”

Mediums of trade (currencies) are solely “price” no matter worth we place on the products and companies we will purchase with them. In 2024, items and companies that price £130.55 sterling might have been bought for $10 in 1970. It is a product of inflation—which actually means inflating the cash supply—and signify an enormous erosion of buying energy. Fiat fairy mud is an appalling retailer of worth. With seemingly limitless magical provide, its depreciation is phenomenal.

The present fiat foreign money primarily based financial system, concentrates wealth, and in the end political authority, within the arms of these invested with the magical energy to create cash out of nothing—the central and industrial banks. Bitcoin, or extra extra particularly the DLT it’s primarily based upon, provides the world the chance, not simply of a brand new financial system, however of a brand new financial paradigm: decentralised finance (DeFi).

When the cash printing presses are managed by a choose few, they’ll “gatekeep” who enters {the marketplace} and who does not. They decide the winners and losers and have consequently constructed a world public-private partnership (G3P) designed to consolidate their community’s world energy and affect. Decentralised and permissionless DLT primarily based DeFi defies G3P energy.

For instance, by placing up your BTC as collateral, you possibly can create a “good contract” to find funds pooled on the DLT to lift funding capital with none recourse to a 3rd occasion, comparable to a financial institution. Whereas such DeFi is presently a nascent and unrefined monetary know-how (FinTech)—and presently excessive risk—the potential to stimulate entrepreneurship, scientific and medical analysis and rather more, absent any centralised management, may benefit humanity drastically.

If Bitcoin is to be scaled as a purposeful, world foreign money, then the “layer 2” blockchain options, such because the Lightening Community, are an unavoidable necessity. This doesn’t imply that Bitcoin can’t stay a permissionless, decentralised foreign money, nevertheless it will increase the prospect of centralisation and management.

Whereas the Bitcoin neighborhood battles to make sure that does not occur, it’s below assault from “off-chain” actors. They view Bitcoin as a tantalising USP for his or her beloved fiat Ponzi Scheme.

The Bitcoin Ponzi Scheme Paradox

Returning to the observations of Shan Zhiguang and He Yifan, they recommend that the Ponzi scheme might be prolonged past the fraudulent accumulation of foreign money:

They not solely revolve round money, however are additionally disguised as fairness. Any such Ponzi scheme might be categorized as an “fairness kind”, which has three predominant traits: first, it’s primarily based on fairness that may be valued; second, the fairness might be traded; lastly, and most significantly, this fairness just isn’t associated to any asset, productive labor or social worth, however is totally made up out of skinny air.

Now think about if, as an alternative of basing your Ponzi Scheme on equities, you create a safety that tracks the efficiency of an underlying asset (commodity) which you can commerce many instances a day. You then supply buyers an “fairness kind” Ponzi scheme utilizing this USP. A Bitcoin Alternate Traded Fund (ETF) would seemingly match the invoice.

Just a few weeks in the past the US SEC authorised spot Bitcoin ETFs. BlackRock responded instantly and publicised its iShares Bitcoin Belief (IBIT). BlackRock state:

IBIT will help take away operational burdens related to holding bitcoin straight, in addition to probably excessive buying and selling prices and tax reporting complexities. BlackRock is the world’s largest ETF supervisor by AUM, managing $3.5T in world ETF funding automobiles as of December 31, 2023.

BlackRock chairman Larry Fink was understandably effusive about IBIT. Talking to CNBC, shortly after the SEC resolution, Fink spelled out what BlackRock take into account:

I do imagine it [Bitcoin] is an alternate supply for wealth holding. I do not imagine it’s ever going to be a foreign money, I imagine it is an asset class. [. . .] [Bitcoin] is not any totally different from what gold represented over 1000’s of years. It’s an asset class that protects you. What we’re making an attempt to do is supply and instrument [Bitcoin ETF] that may retailer wealth. [. . .] We have modified the structure of our agency. [. . .] ETF’s are the first step within the technological revolution of monetary markets. Step two goes to be the tokenisation of each monetary asset. [. . .] We’re taking a look at Bitcoin, we’re taking a look at ETF in the identical method. These are technological adjustments which can be going to permit us [BlackRock] to maneuver ahead.

BlackRock has been earnestly pursuing ETF alternatives since its pivotal 2009 acquisition of Barclays World Traders (BGI). Nonetheless, given its architectural transformation, SEC regulatory approval was very “fortuitous” for BlackRock. Fortunately, the “unbiased” SEC made the appropriate alternative on the proper time for BlackRock.

SEC Bitcoin ETF licensing was met by obvious dismay from the European Central Financial institution (ECB). The influential Metropolis of London linked UK Monetary Occasions virtually laughed within the ECB’s face:

[. . .] no one within the yr of our Lord twenty twenty 4 actually cares what the ECB says about Bitcoin.

The ECB is presently pumping about €980B of flaky Euro denominated fairy mud into European monetary markets. With round $10T of property below administration, BlackRock—the world’s largest asset administration company—doesn’t actually care what the ECB thinks both.

A brand new derivatives ecosystem is being constructed on the again of the spot Bitcoin ETFs. Maybe unsurprisingly, the “lined name” is being utilised once more. The world’s largest crypto asset supervisor, Grayscale, has already launched its $23.5B Bitcoin Belief Coated Name ETF.

Like every Ponzi scheme “irrational exuberance” on the a part of potential buyers is required. Off the again of the SEC resolution, ARK Make investments CEO Cathie Woods predicted a “minimal” projected Bitcoin worth of $600,000 and an optimistic worth of $1.5M by 2030.

Simply as Madoff’s scheme was theoretically believable, so BlackRock’s and different institutional buyers’ Bitcoin ETF buying and selling could properly realise the corresponding valuation. However it will not be a mirrored image of the true “price” of any underlying asset—Bitcoin. Will probably be the product of nothing however hypothesis, “utterly made up out of skinny air.”

How can the fiat foreign money Ponzi scheme have survived for therefore lengthy with out being uncovered? Why have not populations rebelled in opposition to the inflationary wealth switch from them to, what we’d name, a monetary parasite class.

As identified by Mark Goodwin, in “The Delivery of the Bitcoin-Greenback,” by successfully tying the world’s main reserve currency—the US dollar—to oil costs, after which making usually violent manoeuvres to largely management oil manufacturing and the power market, The US greenback, and its economic system, loved what former French President Valéry Giscard d’Estaing known as an “exorbitant privilege.”

Overseas governments want for {dollars} allowed the US financial Ponzi scheme, and thus the world’s, to repeatedly increase. There was a relentless stream of latest buyers. Positive, the impact was to push nationwide sovereign debt past the purpose the place, as an example, the US economic system pays it, however that did not matter so long as the buyers stored rolling in. It is a Ponzi scheme, not a actual financial system.

However all issues “too good to be true” come to an finish. The worldwide dedication to sustainable improvement, shifting the worldwide debt primarily based economic system’s underlying asset from oil to carbon, and the rise of the multipolar world order, shortening provide chains and redistributing world power flows, has added strain to the greenback reserve system. However the grifters aren’t prepared to easily hand over on their fiat Ponzi scheme. They’re as an alternative establishing a world artificial fraud. Bitcoin evidently has a major position to play of their schemes.

It’s Bitcoin’s potential as a retailer of worth that raised the probability of it turning into the idea of the new—or ongoing—fiat financial Ponzi scheme. Now, via its Bitcoin ETF rip-off, the parasite class is shifting to Bitcoin as the brand new gold. A digital gold normal, in case you like.

Goodwin wrote:

We [the Bitcoin community] have recreated the petroldollar mechanisms that permit a retention of internet buying energy for the U.S. economic system regardless of financial base growth. [. . .] [T]right here won’t ever be greater than 21 million bitcoin. [. . .] [B]itcoin is the one commodity to interrupt the pressures of accelerating demand on inflating provide. Bitcoin is the one decentralized monetary mannequin in existence. [. . .] The world economic system now finds itself irreversibly modified by the daybreak of the bitcoin-dollar period.

There’s a Bitcoin Ponzi scheme paradox. Whereas BTC just isn’t a Ponzi scheme, exploited as a commodity, it’s quick being remodeled into the claimed foundation for the continuance of “the biggest Ponzi scheme in historical past”: the fiat foreign money financial system.

The overwhelming majority within the Bitcoin neighborhood wish to see Satoshi’s imaginative and prescient realised. Sadly, such egalitarian aspirations are one thing else world funding establishments like BlackRock do not care about.