Introduction

One in all Bitcoin’s simple and continuously touted strengths is its decentralization. It is usually claimed that the Bitcoin community presents ranges of decentralization, accessibility, and distribution unmatched by some other cryptocurrency. However simply how decentralized is Bitcoin in actuality? And the way will we go about measuring its decentralization? Earlier than delving into these questions, it is essential to make clear the ideas of centralization and decentralization, as they’re usually muddled.

To offer a transparent definition, the centralization/decentralization dynamic could be understood because the diploma of focus/diffusion of authority among the many individuals in a system. Right here, “authority” refers back to the energy to affect the functioning and guidelines of the system, whether or not for malicious or benign functions. With this in thoughts, measuring the diploma of centralization in a system entails quantifying the minimal variety of entities – individuals – required to change its functioning or guidelines. The decrease this quantity, the larger the diploma of centralization. In a seminal 2017 paper on the topic, Balaji S. Srinivasan and Leland Lee launched an insightful metric for this objective: the Nakamoto coefficient.

Derived from the Lorenz curve utilized in calculating the Gini coefficient, the Nakamoto coefficient identifies the minimal variety of individuals essential to compromise or management the system. As an example, within the well-known state of affairs of Bitcoin’s hashrate, if we assume that 5 mining swimming pools collectively possess 50%+1 of the overall hashrate, then this quantity could be 5. Which means that a easy majority of fifty% of the hashrate could be ample to execute a double spending operation on the blockchain. Nonetheless, the important threshold could range for different variables.

Completely different aspects of centralization

Now, let’s handle the core subject recognized by the authors of the paper: figuring out subsystems important to the functioning of the system. In relation to Bitcoin, focusing solely on the focus of hashrate (i.e., miners) fails to seize the complete spectrum of centralization/decentralization throughout the community and overlooks the potential for a 50%+1 assault.

Balaji S. Srinivasan and Leland Lee, of their article, suggest 5 further measurable subsystems of the Bitcoin Community: shopper platform, code builders, nodes, custodial/exchanges, and possession.

In response to Balaji S. Srinivasan, the six dimensions of centralization throughout the Bitcoin community are as follows:

• Shopper centralization

• Possession centralization

• Node centralization

• Builders centralization

• Custodial/exchanges centralization

• Hashrate centralization

As well as, we would think about including one final dimension:

- {Hardware} Centralization

Whereas this checklist is complete, what’s missing is a qualitative evaluation of those dimensions. Which amongst them are really pivotal for Bitcoin’s community performance, and which aren’t?

As an example, one might argue that the shopper or possession variables aren’t as essential in measuring Bitcoin’s decentralization.

Within the first case, Bitcoin Core stands because the de facto customary shopper at this time. Nonetheless, it is value noting that that is an open-source software program authored by Satoshi Nakamoto himself. So long as it stays open-source, actively maintained, and monitored, its dominance does not essentially equate to vulnerability. It is essential to acknowledge the excellence between Bitcoin Core’s hegemony relatively than a monopoly, as theoretically, different operational purchasers exist—akin to Bitcoin Knots, BTCD, Libbitcoin, BitcoinJ, Bitcoin Limitless, Gocoin—that may help the Bitcoin protocol. But, in follow, only a few community nodes make the most of these alternate options, favoring Nakamoto’s unique implementation. On this regard, in 2010, Satoshi Nakamoto himself stated: “I do not consider a second, appropriate implementation of Bitcoin will ever be a good suggestion.”

As for the second dimension listed above – the distribution of Bitcoin possession – this undoubtedly has important socio-economic implications but it surely does not straight have an effect on Bitcoin’s infrastructure. Since Bitcoin depends on a proof-of-work algorithm, the facility that Bitcoin house owners have over nodes and protocol operation is actually nil. The centralization of sat possession might solely turn out to be problematic if foreign money focus reaches such excessive ranges that undermine the community impact, impacting sensible use as a medium of trade and retailer of worth. Happily, as polarized as Bitcoin wealth could also be, we’re removed from this level and based on numerous analyses, as Bitcoin adoption will increase, the focus of sats steadily decreases.

Conversely, subsystems like nodes and coding are pivotal for reaching true community decentralization, being probably essentially the most important factors throughout the Bitcoin system. The danger of node takeover and subsequent arduous forks or coordinated malicious actions on the protocol poses important and lasting threats to community belief. Nonetheless, the likelihood of such occurrences is already low and have continually decreased over time, given the rising variety of energetic or shortly activatable nodes (roughly 16 thousand and 53 thousand respectively, based on the most recent recognized information) and their distribution throughout completely different areas, entities, and authorized jurisdictions.

Within the latter case, nonetheless, the focus of Bitcoin Core code builders—referred to as Core builders and maintainers—stays very excessive and arguably rising from a sure perspective. There are comparatively few programmers actively concerned in writing and sustaining the shopper, regardless of it being a important operate for the whole technological infrastructure of the Bitcoin community. At present, a mean of between 40 and 60 builders contribute to this activity every month based on GitHub information. They resolve voluntarily and independently when and methods to contribute to the event of Bitcoin Core software program on GitHub. In follow, over time, there was a relatively excessive turnover inside this developer neighborhood: it contains each historic builders relationship again to the early variations of Bitcoin Core and plenty of newcomers who joined extra lately. Many historic builders have left over time, whereas others have re-joined later, some function constantly and often, whereas others sporadically. Inside this group, which doesn’t have a formalized hierarchy (and the way might it, being Bitcoin an open-source venture?), there are few key builders, specifically those that oversee the neighborhood’s work. After Wladimir van der Laan left the scene in 2022, the final Bitcoin’s Lead Maintainer, there hasn’t been a single coordinator for work on the Bitcoin Core code. At present, the GitHub work is led by a board composed of 4 senior builders (Gennady Stepanov, Michael Ford, Andrew Chou, and Gloria Zhao), every specializing in overseeing a selected element of the shopper.

One may surprise if such a small and decentralized group of builders/maintainers contributing to the code at this time is perhaps the Achilles’ heel amongst Bitcoin’s numerous subsystems, making the whole construction susceptible to assault. An enormous, complicated, and extremely precious (not solely economically) infrastructure like at this time’s Bitcoin community depends on the customarily part-time and principally unpaid work of some passionate supporters and maintainers. On the one hand, it is true that particular person nodes have the ultimate say on the adoption of every new replace/model of the Bitcoin Core shopper by way of the consensus mechanism. However, one may query what number of nodes really analyze the brand new code for vulnerabilities, dangerous adjustments, or bugs earlier than putting in it.

What would occur if, hypothetically, gradual infiltrations of saboteurs occurred throughout the restricted circle of Key Core builders and Maintainers, with the purpose of first gaining belief and affect in the neighborhood after which hacking the brand new variations of the code? They may, for instance, disguise digital time bombs inside them (within the type of bugs or zero-day vulnerabilities). It is a Machiavellian and complicated speculation to execute, however not unattainable, particularly if we think about a gradual, covert operation performed by entities with important monetary, human, and technological sources at their disposal and with a powerful motivation to disrupt the community, such because the intelligence service of a robust state. What could be the implications of such an operation on Bitcoin if it have been profitable? In all probability fairly critical, if not existential. It might unleash chaos amongst nodes that unwittingly applied the corrupted replace, resulting in pressured arduous forks with results on the steadiness, integrity, and belief within the Bitcoin community. What a technological brute power assault could not accomplish, social engineering aimed toward dismantling consensus might. It is tough to estimate the likelihood of success of such an assault on the Bitcoin Core code, however the small variety of people overseeing its improvement and upkeep, and the relative lack of curiosity from the broader consumer neighborhood of their precious work (and, final however not least, their remuneration), make this subsystem notably susceptible to a well-conceived assault.

When contemplating the realm of custodial and trade companies, the pattern towards larger or lesser centralization is not fully clear-cut. Whereas their numbers have soared for the reason that early days of Bitcoin (assume MtGOX), the lion’s share of buying and selling volumes in opposition to fiat currencies at this time stays concentrated amongst a choose few main gamers (Binance, Bybit, Coinbase, OKX, Kraken, and many others.). The dangers stemming from extreme centralization on this particular subsystem aren’t a lot tied to the safety of the Bitcoin community itself, however relatively to its convertibility with fiat currencies and the safety of these delegating custody (i.e., all these Bitcoin customers entrusting their sats and therefore their “bodily” possession).

Within the first state of affairs, heightened centralization (a discount within the variety of exchanges) would render the system extra susceptible to coordinated authorized or cyberattacks aimed toward disrupting and probably severing the hyperlink between fiat currencies and Bitcoin. This follows the logic that fewer doorways make for simpler locking. Within the second state of affairs, underneath an oligopolistic regime, these choosing custodial options as a substitute of self-custody would face elevated counterparty threat. This is able to outcome from the diminished bargaining energy of customers in direction of custodial counterparts, who might then impose extra burdensome financial situations and extra oppressive clauses (for instance, relating to entry to custodied bitcoins) than they might in a aggressive setting.

Furthermore, with only some giant operators able to controlling important bitcoin portions on behalf of their purchasers, the danger of abuses (akin to non-consensual fractional reserve practices), hacking (the richer the goal, the extra interesting), and political-regulatory interference (together with collusion with public authorities, extreme regulation, and bureaucratization) could be significantly greater in comparison with a extra fragmented and aggressive custodial system.

On the far finish of this counterparty threat spectrum lies the potential for a 6102 assault: the large-scale seizure of bitcoins held on exchanges and custodial wallets inside a sure jurisdiction by legislative motion. Whereas this would not straight affect the functioning of the Bitcoin community, it will probably undermine belief in Bitcoin as a safe technique of fee and retailer of worth among the many normal public, thereby jeopardizing its success as a free permissionless foreign money.

As for the hashrate/mining subsystem, we can’t dwell on it extensively, since each the problems of its decentralization and the potential for 51% assaults have been totally analyzed by much more authoritative sources than us. We’ll merely recall the commonest assault situations: double-spending assaults, selective transaction censorship and the empty block assault. The implications of such assaults shouldn’t be underestimated, however they don’t seem to be essentially existential for the community. There exists a considerable physique of literature explaining the restrictions of a majority of these assaults and the countermeasures that may very well be adopted by the consensus of nodes to thwart or at the least successfully counteract them. …sviluppare..

Lastly, turning to the {hardware} dimension (initially absent within the work of Balaji S. Srinivasan and Leland), we have to analyze the diversification of mining gear when it comes to producers, fashions, and their respective market shares of Bitcoin’s hashrate. It is simple that these days the variety of {hardware} producers for mining (ASICs) has considerably elevated in comparison with the previous. Main firms within the sector embrace Bitmain, Whatsminer, Canaan, Zhejiang Ebang Communication, Halong Mining, Helium, Bitfury, Bee Computing, and HIVE Blockchain. Nonetheless, the overall hashrate of miners is at present dominated by a couple of ASIC fashions and even fewer producers. In response to latest estimates by Coinmetrics, over 70% of the worldwide hashrate is produced by ASICs from a single main firm, Bitmain. Moreover, together with simply three different producers (Whatsminer, Canaan, and Ebang) accounts for nearly the entire computational energy utilized by the Bitcoin community. Furthermore, the overwhelming majority of the hashrate is generated by solely seven ASIC fashions from these aforementioned firms: Antminer S19xp, Antminer S19jpro, Antminer S19, Canaan 1246, Antminer S17, MicroBT m20s, and MicroBT m32.

The dangers of such centralization of {hardware} when it comes to fashions and producers are quite a few. With only a few giant producers, primarily now situated in China, they might simply be compelled by governments and lawmakers of the jurisdictions they’re topic to, to halt manufacturing of their amenities, hand over batches of manufactured {hardware}, or secretly infiltrate backdoor {hardware} and trojans into their ASIC fashions. The implications would instantly affect the mining subsystem, inflicting instability and probably a collapse within the community’s hashrate, leading to important financial losses for miners utilizing corrupted ASICs or these unable to accumulate new ones. A considerably decrease and extended hashrate would scale back the safety of the whole community, as it will enhance the probabilities of a 51% assault, maybe exactly by the actor who initiated the {hardware} assault. Right here, we see how an assault on one poorly decentralized subsystem can nearly weaken one other and thus assault it in a harmful chain response with harmful penalties for the integrity of the Bitcoin community.

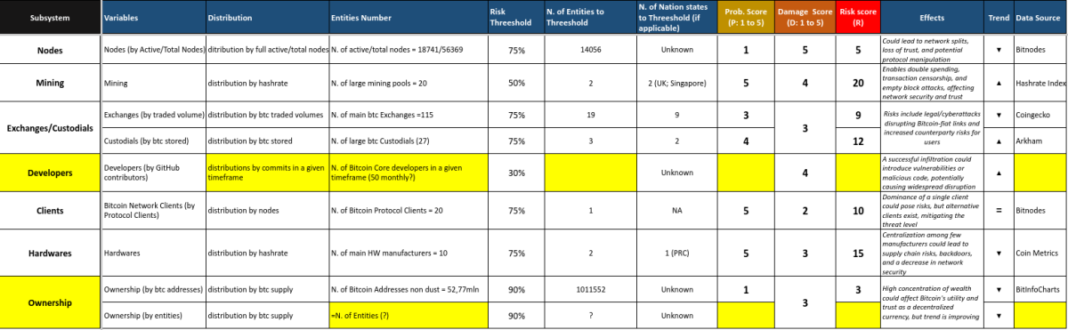

Given this non-exhaustive overview of the assorted subsystems of Bitcoin and their vulnerabilities, we are able to endeavor to synthesize the six dimensions right into a single desk. This desk would measure the danger of centralization as a matrix between likelihood (P) and harm incidence (D, that means the relevance of results on the community), illustrating the dynamics towards rising or lowering centralization.

R=P*D

Geographical and Financial Decentralization

There are additionally different points of the decentralization/centralization dichotomy that lower throughout the six sorts simply illustrated: geographical (jurisdictions) and financial (financial entities). Geographical decentralization addresses the query: the place are the nodes, wallets, exchanges/custodians, and miners bodily and legally situated? Financial decentralization, then again, issues the financial possession of those entities: for instance, who owns the mining swimming pools? Or who controls the exchanges? The geographical and financial points could seem overlapping at first look, however in actuality, they aren’t in any respect. As an example, there may very well be a Bitcoin ecosystem the place there are various impartial miners, however all situated throughout the similar jurisdiction and thus topic to the identical political-legal threat. Right here, financial/possession centralization could be low, whereas geographical centralization could be very excessive. Conversely, there may very well be many miner factories scattered throughout the globe however managed by the identical financial entity and due to this fact successfully thought-about as a single level of failure. The identical argument might equally apply to nodes, {hardware} or bitcoin possession. In a world dominated by states and huge firms, neglecting these components could be deadly. The mere variety of individuals in a Bitcoin subsystem tells us little about decentralization if they’re principally concentrated in a single jurisdiction or topic to the identical financial management. Due to this fact, each the qualitative geographical parameter and the financial parameter needs to be built-in into any try and measure the diploma of decentralization of the Bitcoin community.

What adjustments with ETFs?

The latest emergence of Bitcoin ETFs within the US market could have a substantial affect on the decentralization of the community, notably in regards to the Custodial/Exchanges subsystem. Whereas investing in an ETF considerably simplifies entry to bitcoin efficiency in comparison with different fiduciary options, this selection doubles (if not triples) the counterparty dangers for traders. Those that “spend money on bitcoin” by way of an ETF don’t really possess or personal the property; they’re topic to each the counterparty threat of the ETF supervisor and that of the Custodial/Depository to which the ETF depends on (if the supervisor doesn’t go for an unlikely self-custody), in addition to the danger of the middleman/dealer by way of which they purchase the instrument. In follow, the adage “Not your keys, Not your cash” reduces to a easy “Not Your Cash, goodbye” particularly within the case of an hypothetical 6102 assault utilized on ETFs.

On a macro stage, the identical arguments made for custodial/trade entities apply to passive funds on Bitcoin: the extra they’re utilized by institutional and retail traders as a type of “funding in bitcoin,” the extra bitcoin is absorbed into their plenty. Consequently, their coercive energy over customers and contractual (i.e., financial) energy over different subsystems of the Bitcoin Community enhance. If a selected Bitcoin ETF have been to accumulate a major (if not dominant) market share of circulating bitcoin over time and systematically use its proceeds to subsidize builders of the Bitcoin Core shopper, it might affect their actions, information shopper implementations, and thus the event route of the whole community in direction of its needs. This is able to be a case the place the centralization of 1 dimension (that of custodians by way of ETFs) results in the centralization of a way more very important dimension: that of builders mentioned earlier.

This can be a visitor publish by Michele Uberti. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.