Bitcoin (BTC) took a nasty spill over the weekend. Plunging to a gut-wrenching $60,850 earlier than staging a partial restoration to hover round $64,500, this sudden value drop has left the crypto group scrambling for solutions.

Veteran dealer Peter Brandt, recognized for his eagle eye on market patterns, has stepped into the ring to supply his insights, sparking debate about what this implies for Bitcoin’s future.

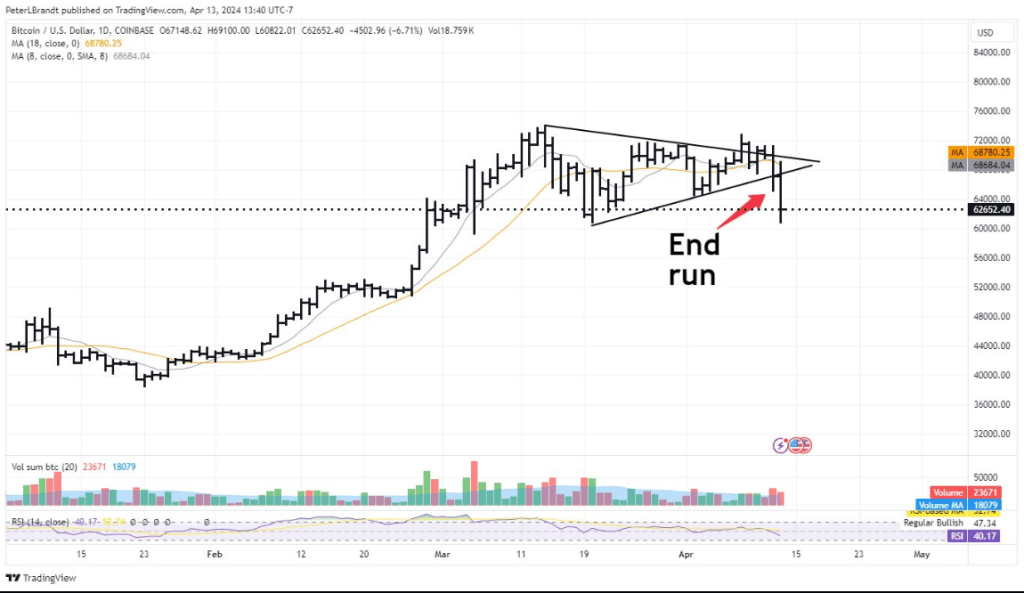

Bitcoin At A Crossroads: The ‘Finish Run’ Concept

Brandt, a seasoned campaigner within the often-unpredictable world of crypto buying and selling, sees the latest value motion as a possible turning level. He makes use of the intriguing time period “finish run” to explain this pivotal second.

Borrowed from the world of sports activities, an finish run signifies a strategic maneuver designed to bypass obstacles and achieve a bonus. Within the context of Bitcoin’s latest dip, Brandt suggests it may very well be a strategic shift out there dynamics, paving the best way for a big transfer in both route.

Finish run accomplished in Bitcoin $BTC@chartwizardsnft pic.twitter.com/YlHISyT85D

— Peter Brandt (@PeterLBrandt) April 13, 2024

Brandt’s evaluation hinges on a technical indicator – a symmetrical triangle sample forming on Bitcoin’s value chart. This sample usually indicators a interval of consolidation earlier than a breakout, both upwards or downwards.

In accordance with technical evaluation rules, a breakdown from the underside trendline of the triangle may usher in a bearish pattern, whereas a breakout from the highest may set off a bullish surge. Brandt’s interpretation of the latest drop because the “finish run” implies Bitcoin is poised for a breakout, however the query stays – which route will it break?

Bullish Undercurrent Regardless of Brief-Time period Jitters

Whereas the rapid future could be shrouded in uncertainty, Brandt maintains a agency perception in Bitcoin’s long-term potential. He has beforehand predicted Bitcoin reaching a staggering $200,000 by 2025, a testomony to his unwavering confidence within the cryptocurrency’s skill to realize substantial progress. Viewing the present dip as a wholesome correction inside a bigger upward pattern aligns along with his total bullish stance on Bitcoin’s trajectory.

Complete crypto market cap is at the moment at $2.352 trillion. Chart: TradingView

The Crypto Market: A Balancing Act Between Worry And Alternative

The latest Bitcoin value drop and the following evaluation from Peter Brandt have uncovered the inherent rigidity throughout the cryptocurrency market – a continuing tug-of-war between worry and alternative.

Associated Studying: Toncoin Defies Market Turmoil, Surges 25% To Tally All-Time Excessive – Particulars

Some buyers see the dip as a golden shopping for alternative, an opportunity to build up Bitcoin at a cheaper price level in anticipation of a possible bullish breakout. Others, scarred by the crypto market’s infamous volatility, stay cautious, cautious of the opportunity of additional value declines.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal threat.