Brief-term Bitcoin holders have been happening a shopping for spree these days, accumulating over 1.2 million BTC since December 2023, in line with Glassnode. Bitcoin has acquired main curiosity from buyers because the starting of the yr, and rightly so, contemplating the quantity of consideration introduced by the launch of Spot Bitcoin ETFs within the US.

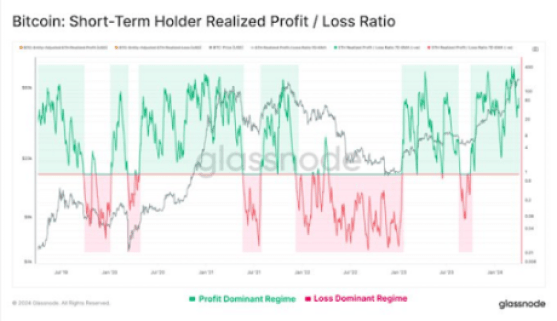

Whereas the cryptocurrency has gone by an prolonged interval of bullish motion, nearly all of the buildup pattern has largely been attributed to whales and addresses holding massive quantities of Bitcoin for lengthy intervals. Nevertheless, latest information from Glassnode has revealed an attention-grabbing accumulation pattern amongst short-term holders. On the similar time, the revenue/loss ratio of this cohort of trades has remained effectively throughout the revenue zone because the starting of the yr, with revenue taking outsizing losses by 50x.

Curiosity In Bitcoin Amongst Retail Traders

Traders have seen Bitcoin struggling to commerce above the $70,000 value stage because the center of March. Nevertheless, Bitcoin on-chain information has just lately revealed an attention-grabbing accumulation pattern from Bitcoin’s holding addresses. Significantly, 21,400 BTC, value round $1.40 billion, had been moved into these addresses previously few days, indicating the shopping for stress may be again already.

The collective holding of short-term holders has been quickly climbing since December 2024 whereas the long-term holders have been distributing. Brief-term holders are these wallets that maintain Bitcoin just for a couple of weeks or months at a time. The truth that so many new cash have entered short-term holder wallets just lately exhibits that many buyers have been pouring into the market. This, in flip, may counsel the cryptocurrency has lastly achieved full-scale adoption, which may result in continued value development over time.

Revenue/loss information reveals short-term holders have collectively been in revenue because the starting of the yr. In line with Glassnode, short-term holders have been shopping for and promoting at a revenue for almost all of 2024 to date. Actually, the short-term holder revenue has outsized losses by 50 instances. Because of this over 49 out of fifty short-term holders had been promoting their Bitcoin for the next value than what they paid.

Supply: Glassnode

Apparently, Bitcoin’s latest ascent to a brand new all-time excessive noticed the short-term holder realized revenue/loss ratio reaching its highest level ever on the 7D Exponential Transferring Common.

Retail Curiosity To Push BTC Worth?

The shopping for spree by each short-term and long-term holders means that each retail and institutional curiosity in Bitcoin is now at its highest level. Fundamentals level to the doubtless continuation of this pattern all through April, particularly with the method of the subsequent Bitcoin halving.

On the time of writing, Bitcoin is buying and selling at $66,903, up by 1.87% previously 24 hours.

BTC value drops beneath $67,000 | Supply: BTCUSD on Tradingview.com

Featured picture from Yahoo Finance, chart from Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site totally at your individual danger.