The server market is bouncing again in worth phrases, as clients demand beefier techniques to coach or run AI fashions – and the success of server makers is now largely depending on getting GPUs from Nvidia.

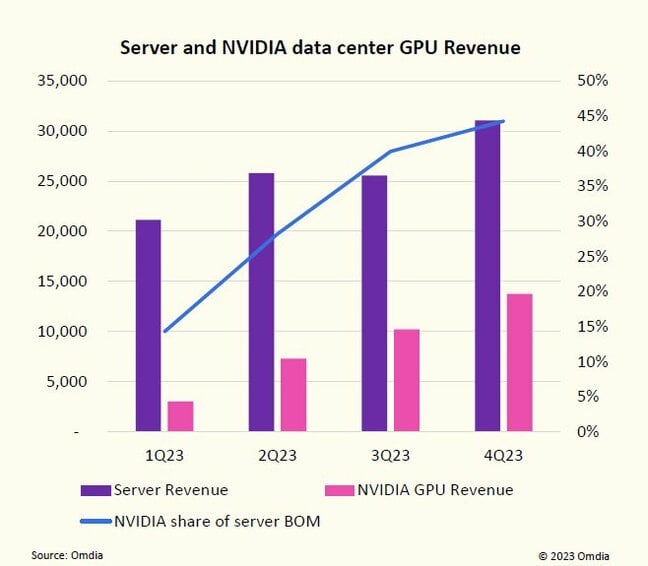

Analyst Omdia says in its newest Cloud and Datacenter Market Snapshot that international server income grew to $31 billion in calendar This autumn, up 12.7 % year-on-year and up 21.5 % on the prior quarter.

The pattern of shoppers shopping for extra richly configured servers to fulfill the necessities of AI processing was famous by Omdia final 12 months, and is gaining momentum pushed by the surging curiosity in generative AI fashions sparked by ChatGPT.

The upshot is that the quantity of servers shipped in 2023 really dropped under the forecast as consumers funneled their funding into AI heavyweight {hardware}. Omdia says that preliminary knowledge signifies the variety of servers shipped within the quarter was between 2.8 and a pair of.9 million items, or half one million fewer than estimated, and the bottom since 2017.

“This reaffirms our thesis that finish customers are prioritising funding in extremely configured server clusters for AI to the detriment of different tasks, together with delaying the refresh of older server fleets,” the report states.

Unsurprisingly, the massive winner right here is Nvidia, whose chips reminiscent of the present H100 and A100 are in excessive demand for accelerating the coaching of AI fashions specifically. Nvidia GPUs now account for about 44 % of the server invoice of supplies (BOM) on common, Omdia estimates.

With every H100 carrying an eye-popping price ticket of roughly $21,000, it is little marvel that the value of servers has elevated, and Omdia put Nvidia’s income throughout its datacenter GPU portfolio at $13.7 billion for This autumn of 2023.

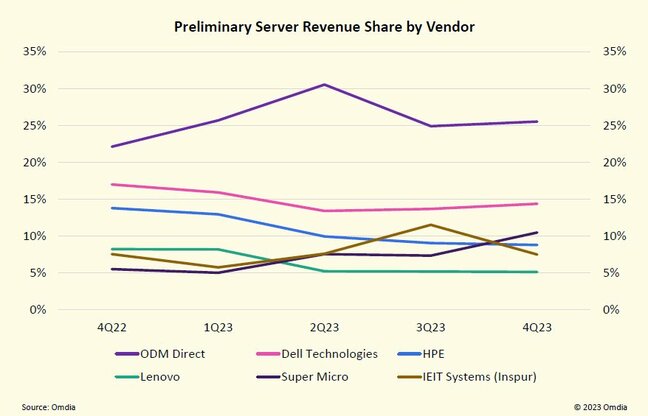

Nvidia’s significance to the server market is now so nice that Omdia says the GPU builder is successfully a kingmaker, and an in depth working relationship with the Santa Clara-based biz shall be key for any server maker eager to develop its share of the market in 2024.

To help this, Omdia highlights hyperscale cloud provider Supermicro, which grew its share of server market income from 5 to 10 % over the course of 2023 primarily based on AI server gross sales, overtaking HPE in This autumn.

HP was itself hit by GPU shortages that dented income progress, as outlined in monetary outcomes disclosed final week. Simply days in the past, Dell additionally talked of a $2.9 billion AI server backlog, which served to drive its share worth to file highs not seen because the firm went public once more in 2018.

One other consider falling normal server cargo may be corporations extending the lifetime of their techniques. The Register reported final month that Amazon had prolonged the working lifetime of its package from 5 to 6 years, a transfer it expects will save tons of of hundreds of thousands of {dollars} in Q1 of this 12 months alone. Microsoft and Google have additionally made comparable strikes.

Omdia estimates that the typical lifetime of servers positioned in enterprise datacenters or colocation has now elevated to 7.6 years, whereas the hyperscale suppliers raised the typical lifespan of their package to six.6 years throughout 2023.

Delaying the refresh of current servers has allowed corporations to release extra funds for AI clusters, Omdia claims, saying that if server life spans for these hyperscalers have been to succeed in seven years, formal disclosures will probably be made. ®