When bitcoin adoption reaches a worldwide scale, it’s seemingly there’ll not be bitcoin podcasts, bitcoin conferences and even, sorry to say this, a necessity for a Bitcoin Journal. Nonetheless, till this level, folks fascinated about bitcoin can be differentiated from those that are but to start their journey down the bitcoin rabbit gap. The query is then raised, how does a bitcoiner describe themselves to others, that will assist bridge the chasm between their very own understanding and people nonetheless plugged into The Matrix?

Given the inflationary insurance policies of successive governments, globally (see Rune Østgård wonderful ebook Fraudcoin for extra info), almost everybody with sources has needed to change into an “investor” merely to aim to keep up buying energy extra time.

Individuals who need to personal the place they dwell, have the power to personalise the place they spend their time, and (for probably the most half) not be involved about eviction or be subjected to extreme prices of rental, mustn’t need to view themselves as buyers. Nonetheless, attributable to financial premia commanded by actual property, not solely do folks have to take dangers by leveraging their belongings to buy houses (by means of mortgages), they might additionally have to speculate that sooner or later, the worth of their residence can have elevated sufficiently to offset the prices incurred of buying, transferring and canopy the curiosity on their debt.

Alongside the necessity to construct wealth by means of “arduous belongings” akin to property, the non-bitcoiner can be directed and infrequently supported in planning for the longer term by means of additional investments within the type of a pension. Whereas tax effectivity and, for these fortunate sufficient, extra employer contributions assist to extend advantages, the funding associated dangers are diminished. Nonetheless, these advantages additionally must be understood in relation to the counterparties concerned, akin to adjustments in authorities coverage, adjustments in pension schemes or the worst-case state of affairs of the corporate offering the pension experiencing monetary difficulties. Studying that the pension you may have been paying into for 30 years now has no worth by means of no fault of your individual is kind of merely heartbreaking to observe.

For the reason that public acknowledgement by Blackrock that bitcoin could not really be an “index of cash laundering”, bitcoin as an funding grade asset is changing into an accepted narrative. This might imply that bitcoin can start to be thought of alongside equities, actual property and pensions as a method on sustaining buying energy whereas additionally planning for the longer term. Nonetheless, trying again, this notion could merely be a degree on an ever altering journey, from its origins inside somewhat recognized Cypherpunk mailing checklist that considered it as a collectible, by means of the medium of alternate on the Silk Street to the place we’re as we speak. With an eye fixed on the longer term, it could be prudent to start pondering of what description will come subsequent for somebody who owns bitcoin, that can make extra sense sooner or later aside from an “investor”. The very nature of bitcoin additionally means that it’s in contrast to different belongings (both commodities or securities), which means that it is perhaps fallacious to view it as both.

Sadly, per consciousness of bitcoin not being even distributed, publicly held views of the asset are additionally somewhat inconsistent. As lately as Could, 2023, Harriet Baldwin MP, of the UK Parliament Treasury Committee really useful that “unbacked ‘tokens’” (together with bitcoin), must be regulated as “playing somewhat than as a monetary service”. Whereas that is largely true for “cryptoassets” extra broadly, that is merely fallacious in relation to bitcoin, given it’s backed by the world’s largest pc community operating a protocol that’s extraordinarily resilient to vary. The character of the bitcoin protocol signifies that in contrast to actual property or pensions, adjustments in authorities, organisational insurance policies or an organisation’s efficiency can’t have an effect on its operation or utility sooner or later. Together with this, given the fastened provide of bitcoin, it’s also not subjected to debasement by means of inflationary insurance policies that impacts the unit of account for different belongings.

As a consequence, whereas previous information exhibits the greenback worth of bitcoin is very risky (impacted by provide and demand dynamics), the dangers related to the asset itself are literally extraordinarily low. When that is mixed with the power to self-custody the asset, at low price, additional dangers are eliminated when in comparison with the necessity for shares in corporations or commodity certificates to be custodied by brokerage companies.

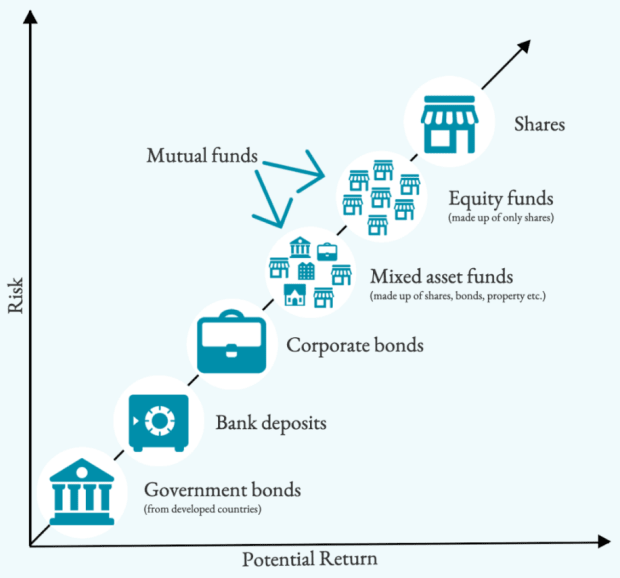

Normal definitions of investing focus upon an expectation that cash invested will develop, although any knowledgeable investor will do that by balancing the potential progress in opposition to any related dangers. From the treasury committee’s viewpoint, the dangers and returns related to playing would seemingly find bitcoin past the highest proper nook of the determine beneath.

From the attitude of shopping for bitcoin being comparable in nature of playing, promoting a fiat forex for bitcoin, with an opportunity, somewhat than an expectation of progress could then counsel that bitcoin could not really be capable to be classed as an funding.

To additional query the above determine, occasions seem to have modified from when this well-established thought was developed, precipitating the necessity for reflections on beforehand held assumptions. Authorities bonds are not “threat free”, illustrated by the worldwide rates of interest will increase leading to dramatic losses within the worth of presidency bonds in 2022. This example has then impacted the dangers related to financial institution deposits, resulting in latest failures of enormous banks within the US. Compared to each authorities bonds and financial institution deposits, the safety of bitcoin is neither subjected to central financial institution rate of interest coverage threat nor third-party dangers related to the holders of presidency bonds (even when the short-term worth could change). Given the fastened emission schedule of bitcoin, it’s also not subjected to “cash printing” and authorities deficits which have diminished the buying energy of the underlying forex, as promoted by Fashionable Financial Concept.

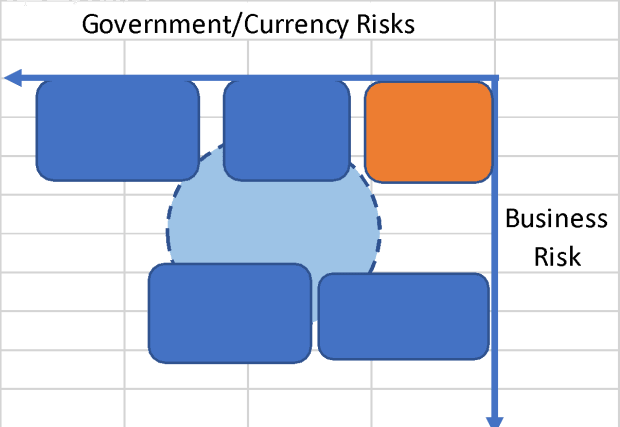

Fascinatingly, in a latest doc from Blackrock, this contrarian viewpoint is supported, suggests a bitcoin allocation of 84.9% inside an funding portfolio, representing a really totally different threat profile when in comparison with different belongings (Thanks Joe). Apart from the volatility related to markets trying to cost a brand new asset, this implies that bitcoin is the place Blackrock would advocate holding the vast majority of your wealth. The determine beneath thus suggests another framing when evaluating bitcoin to different belongings, the place as an alternative of presenting returns on funding, consideration is given to the dangers of the underlying unit of account (fiat forex) in opposition to the enterprise threat.

Throughout the present excessive inflation setting, forex and enterprise associated dangers are heightened. Historical past then supplies a sobering perspective on the impression of inflation on the well-being of a inhabitants (see When Cash Dies). Throughout Weimar Germany, because of the problems with the forex, those that invested skilled durations of optimistic returns, however have been later ruined as hyperinflation took maintain. On this context, somewhat than investing in gold, those that merely saved in it may experience out the risky value actions. In a captivating echo, the identical has been demonstrated in Argentina as we speak with bitcoin. Buyers or merchants are prone to have misplaced cash, however in the long run, saving in bitcoin has been a significantly better choice for the common Argentinian.

So sure, I’m a bitcoiner, however that doesn’t imply I’m an investor, speculator, gambler or a prison and whereas I’d wish to be, I’m additionally not a Cypherpunk. I’m merely somebody working in the direction of a greater future for myself, my household and possibly even their households. Bitcoin seems to supply a method of transferring the worth of my work as we speak into the longer term, with out the dangers of it being mismanaged (equities), legislated in opposition to (pensions), susceptible to central financial institution coverage (authorities bonds and fiat currencies) or struck by lightning (actual property). Because of this, bitcoin might not be an funding and is just a hypothesis or gamble in case you purchase it with out understanding it.

To return to the title, when requested about themselves and the way they’re planning for the longer term, a bitcoiner can merely say, “I’m staying humble, appreciating I’ve loads to study however saving the perfect asset I can discover” (see Mickey’s work for a macro viewpoint). Hopefully, it will pique their curiosity, so result in the comply with up query of “are you able to inform me extra?”. At which level, the orange pilling can start.

This can be a visitor publish by Rupert Matthews. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.