The long-awaited recession and ensuing resumption of the 2022 bear market that many have been anticipating has did not materialize up to now in 2023. In truth, most belongings have caught a bid, with the NASDAQ hitting a 52-week excessive on July 12.

How can this be, and can the rally proceed?

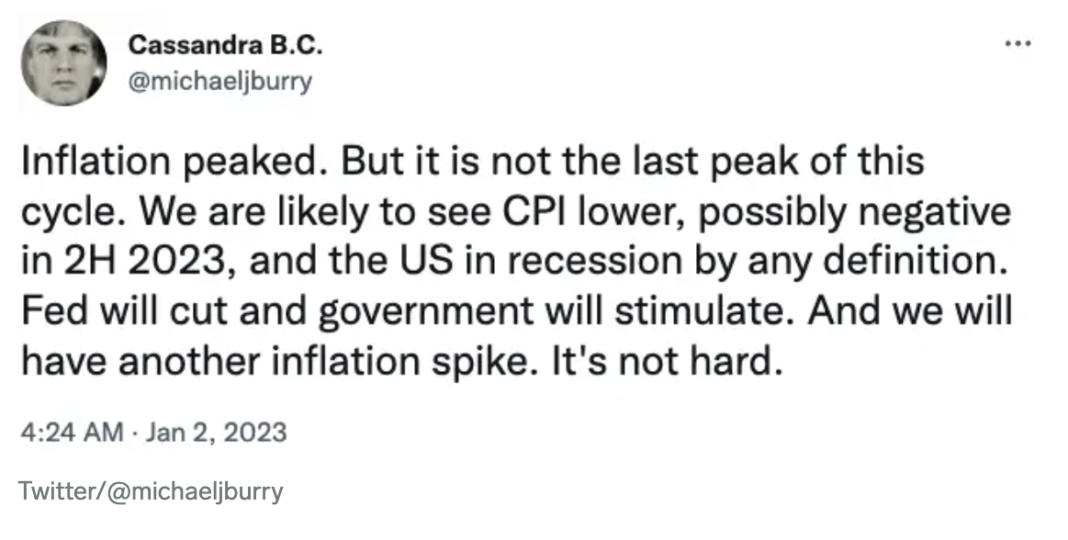

Michael Burry of Huge Brief fame declared in January that the US may very well be in recession by late 2023, with CPI decrease and the Fed chopping charges (observe that at this time’s CPI print got here in a lot decrease than anticipated, additional fueling the current rally). This might result in one other inflation spike in his view.

Lately unbiased macro and crypto analyst Lyn Alden explored the subject in a publication revealed this month.

Within the report, Alden examines at this time’s inflationary surroundings by contrasting it to 2 related however totally different durations: the Forties and the Nineteen Seventies. From this, she concludes that the US financial system will seemingly enter stall pace or expertise a gentle recession whereas experiencing some degree of persistent inflation. This might imply that markets proceed trending upward till an official recession hits.

My July 2023 publication is out:https://t.co/gTH0nUyrU8

The subject deal with fiscal dominance, and the way massive money owed and deficits can mute the affect of upper rates of interest as a coverage software. pic.twitter.com/qmuzInyYjK

— Lyn Alden (@LynAldenContact) July 2, 2023

The Fed’s inflation combat continues

The essential distinction between the 2 durations entails fast financial institution lending and huge monetized fiscal deficits, which Alden suggests are the underlying components driving inflation. The previous occurred within the Nineteen Seventies as child boomers started shopping for homes, whereas the latter occurred throughout World Conflict II because of funding the warfare effort.

The 2020s are extra just like the Forties than the Nineteen Seventies, but the Fed is operating the Nineteen Seventies financial coverage playbook. This might turn into fairly counterproductive. As Alden explains:

“In order the Federal Reserve raises charges, federal curiosity expense will increase, and the federal deficit widens satirically at a time when deficits have been the first explanation for inflation within the first place. It dangers being akin to making an attempt to place out a kitchen grease fireplace with water, which makes intuitive sense however doesn’t work as anticipated.”

In different phrases, at this time’s inflation has been primarily pushed by the creation of recent federal debt, or what some could name authorities cash printing.

Elevating rates of interest to calm inflation can work, nevertheless it’s meant for inflation that has its roots in an enlargement of credit score tied to banking loans. Whereas larger charges tame such inflation by making borrowing dearer and thus lowering mortgage creation within the non-public sector, they make fiscal deficits worse by growing the quantity of curiosity owed on these money owed. The federal debt at this time is over 100% of GDP, in comparison with simply 30% within the Nineteen Seventies.

Whereas the Federal Reserve has cooled some elements of the financial system by elevating charges by 500 foundation factors in little greater than a 12 months, the underlying trigger of the present inflationary surroundings stays unaddressed. And with a a lot larger debt-to-GDP ratio than The united stateshad 50 years in the past, the state of affairs solely worsens at a sooner tempo. However markets have remained resilient, together with tech equities and crypto, although the correlation between the 2 has damaged.

On this approach, the Fed could also be utilizing a software unfit for the state of affairs, however this hasn’t stopped markets, a minimum of for now.

Huge Tech defies recession estimates and propels equities

Regardless of the Fed’s battle with inflation and market members’ expectation of an unavoidable recession, the primary half of 2023 has been fairly bullish for equities, with the rally extending into July. Whereas bonds have offered off once more, elevating yields to near-2022 highs, threat belongings like tech shares have been hovering.

It’s essential to notice that this rally has primarily been led by simply 7 shares, together with names like Nvidia, Apple, Amazon, and Google. These equities make up a disproportionate weight of the NASDAQ:

Simply seven shares make up 55% of the NASDAQ 100 and 27% of the S&P 500

The distribution has develop into so lopsided that the NASDAQ will probably be rebalancing to offer these megacaps much less weight.

Supply: @GoldmanSachs pic.twitter.com/k1xM1wmL2S

— Markets & Mayhem (@Mayhem4Markets) July 13, 2023

Associated: Bitcoin mining shares outperform BTC in 2023, however on-chain information factors to a possible stall

Bonds down, crypto and tech up

The rally in tech due largely to AI-driven hype and a handful of mega cap shares has additionally caught a tailwind from an easing in bond market liquidity.

Alden notes how this started late final 12 months:

“However then some issues started to alter at the beginning of This autumn 2022. The U.S. Treasury started dumping liquidity again into the market and offsetting the Fed’s quantitative tightening, and the greenback index declined. The S&P 500 discovered a backside and started stabilizing. The liquidity in sovereign bond markets started easing. Varied liquidity-driven belongings like bitcoin turned again up.”

A July 11 report from Pantera Capital makes related observations, noting that actual rates of interest even have a really totally different story to inform when in comparison with the Nineteen Seventies.

“The standard markets could battle – and blockchain could be a secure haven,” partly as a result of “The Fed must proceed to boost charges,” on condition that actual charges stay at -0.35%, based on the report. Additionally they conclude from this that “There’s nonetheless tons of threat in bonds.”

They go on to notice that whereas most different asset courses are delicate to rates of interest, crypto will not be. Bitcoin’s correlation to equities throughout 2022 was pushed by the collapse of “over-leveraged centralized entities.” At the moment, that correlation has reached near-zero ranges:

Among the many key takeaways right here could also be that threat belongings seem to have a bid below them in the interim. Nonetheless, this pattern might simply reverse by 12 months finish.

Dan Morehead of Pantera Capital stated it effectively when stating that:

“Having traded 35 years of market cycles, I’ve discovered there’s simply so lengthy markets could be down. Solely a lot ache traders can take…It’s been a full 12 months since TerraLUNA/SBF/and many others. It’s been sufficient time. We will rally now.”

With the halving proper across the nook and the prospect of a spot bitcoin ETF on the horizon, the catalysts for crypto appear poised for a breakout in virtually any state of affairs.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.