Bitcoin (BTC) tried to interrupt away from its boring sideways value motion on July 13 following Ripple’s authorized victory over the USA Securities and Alternate Fee, however the enthusiasm proved to be short-lived. Sellers pulled the value again into the vary on July 14, indicating that they continue to be lively at increased ranges. Nonetheless, a constructive signal is that the bulls have saved Bitcoin’s value above $30,000.

Market observers are anticipated to intently comply with the overview course of for the assorted exchange-traded fund (ETF) proposals for a spot Bitcoin ETF, distinguished being the proposal by BlackRock. Apparently, out of 550 ETF purposes by BlackRock, just one has been rejected, in response to Bloomberg Intelligence’s Eric Balchunas and James Seyffart.

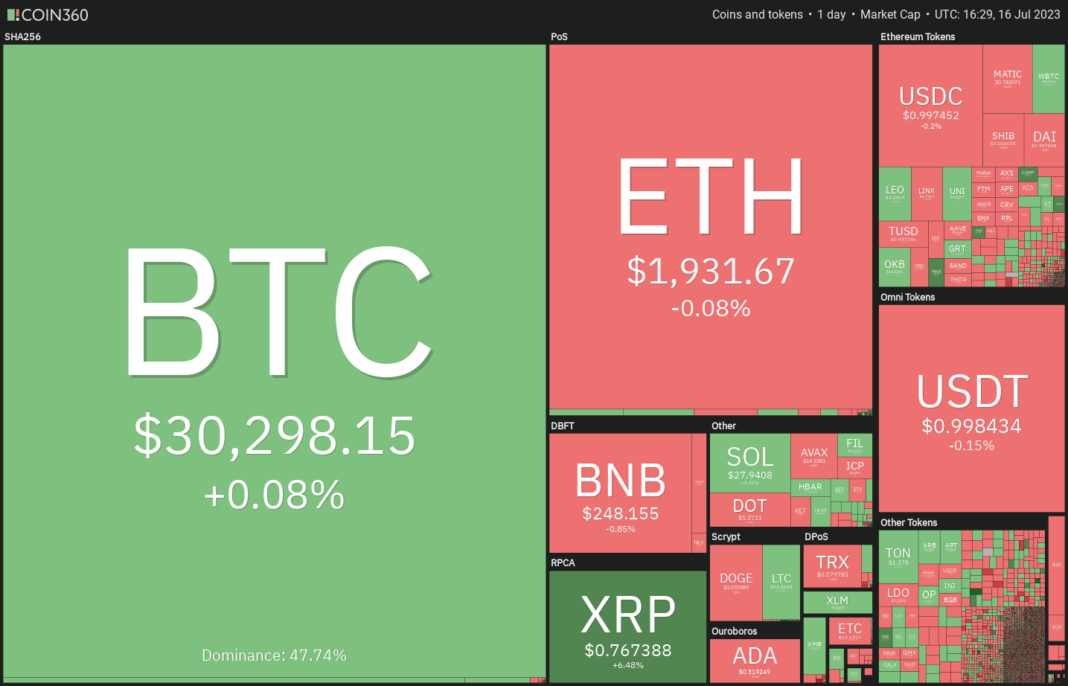

At the same time as Bitcoin consolidates ready for its subsequent catalyst, a number of altcoins are witnessing stable shopping for. This has pulled Bitcoin’s market dominance beneath 50%, suggesting that the main target might be shifting to the altcoins within the close to time period.

May Bitcoin begin a trending transfer within the brief time period or will it stay caught contained in the vary? What are the altcoins which are wanting robust on the charts? Let’s research the charts of top-5 cryptocurrencies that might be on dealer’s radar within the subsequent few days.

Bitcoin value evaluation

Bitcoin closed above $31,000 on July 13 however that proved to be a bull entice as a result of the bears yanked the value again beneath the extent on July 14. This exhibits that the bears are fiercely defending the zone between $31,000 and $32,400.

The worth motion of the previous few days has fashioned a bearish divergence on the RSI. This means a weakening bullish momentum. The bears will attempt to construct upon their benefit by pulling the value beneath the 20-day exponential shifting common ($30,187). In the event that they handle to do this, the BTC/USDT pair may descend to the 50-day easy shifting common ($28,631).

If bulls need to stop the decline, they should rapidly push and maintain the value above $31,000. The pair may then climb to $32,400. A break and shut above this stage will clear the trail for a possible run to $40,000 as there aren’t any main resistances in between.

The pair has dropped beneath the shifting averages on the 4-hour chart, indicating that demand dries up at increased ranges. The bears should sink and maintain the value beneath $29,500 to begin a deeper correction. The pair may then plummet to $27,500.

Alternatively, the bulls should push and maintain the value above $31,000 to begin an up-move towards $32,400. If the value turns down from $32,400 however rebounds off $31,000, it can recommend that the bulls have flipped the extent into assist. The pair might then begin a rally to $40,000.

Uniswap value evaluation

Uniswap (UNI) has been taking assist on the 20-day EMA ($5.41) throughout pullbacks indicating that the sentiment has turned constructive and merchants are shopping for the dips.

The bulls will attempt to purchase the present dip and push the value above the quick resistance at $6.16. If they’ll pull it off, the UNI/USDT pair may rise to $6.50. This stage might once more act as a powerful resistance but when bulls don’t quit a lot floor, the pair may attain $6.70.

The essential assist to observe on the draw back is the 20-day EMA. A break and shut beneath this stage will recommend that the bears are again within the recreation. The pair might then fall to the 50-day SMA ($5) and later to the essential assist at $4.72.

The correction on the 4-hour chart has reached the 20-EMA. That is the primary essential assist to be careful for. If the value rebounds off this stage, the pair may retest the overhead resistance at $6.17. Above this stage, the pair might climb to the resistance line of the ascending channel.

Contrarily, if the value slips beneath the 20-EMA, it can recommend that the short-term merchants could also be reserving income. That would pull the value all the way down to the assist line of the channel. If this stage cracks, the pair might slide to $5.08.

Arbitrum value evaluation

Arbitrum (ARB) broke and closed above the symmetrical triangle sample on July 15, indicating that the bulls have overpowered the bears.

The 20-day EMA ($1.16) has turned up and the RSI has reached close to the overbought zone, indicating that the trail of least resistance is to the upside. There’s a minor resistance at $1.36 but when that stage is crossed, the ARB/USDT pair might surge to $1.50. This stage might once more pose a powerful problem but when bulls overcome it, the rally might prolong to $1.70.

This constructive view will invalidate within the close to time period if the value turns down and plummets beneath the assist line of the triangle. That will entice a number of aggressive bulls, leading to a pointy drop to $0.90.

The bulls efficiently held the retest of the breakout stage from the symmetrical triangle, indicating that decrease ranges are attracting consumers. The bulls will attempt to construct upon this power by driving the value above $1.36. In the event that they succeed, the pair might choose up momentum.

Quite the opposite, if the value turns down from the present stage or $1.36, the bulls will once more attempt to drag the pair again into the triangle. In the event that they do this, it can recommend that the latest breakout might have been a bull entice. The pair may then drop to the 50-SMA and subsequently to the assist line of the triangle.

Associated: Shopping for the dip? Report 3.8% of the Bitcoin provide final moved at $30.2K

Aave value evaluation

Aave (AAVE) broke and closed above the descending channel sample on July 3. The bulls efficiently held the retest of the breakout stage on July 6 and once more on July 10. This exhibits that the bulls flipped the resistance line into assist.

The rising 20-day EMA ($72) and the RSI within the constructive territory point out that the bulls are in command. If the value turns up from the present stage or bounces off the 20-day EMA, it can improve the prospects of a rally above $84.50. The AAVE/USDT pair may then rally to $95.

Opposite to this assumption, if the value turns down and breaks beneath the 20-day EMA, it can recommend that the bulls could also be shedding their grip. The bears will then once more attempt to tug the value again into the descending channel.

The 4-hour chart exhibits that the bulls pushed the value above the overhead resistance of $84.50 however they may not maintain the breakout. The bears bought at increased ranges and pulled the value again beneath the 20-EMA.

Each shifting averages have flattened out and the RSI is close to the midpoint, indicating a stability between provide and demand.

If the value breaks beneath the 50-SMA, the benefit might shift in favor of the bears. The pair may then slide to $68. The benefit will shift in favor of the bulls in the event that they keep the value above $84.50.

Maker value evaluation

Maker (MKR) broke above the downtrend line on July 2 and efficiently retested the extent on July 14. The bounce off this assist suggests robust demand at decrease ranges.

The upsloping 20-day EMA ($878) and the RSI within the constructive zone sign that bulls are in management. Consumers are trying to renew the up-move however might face stiff resistance close to $1,100. If bulls clear this hurdle, the MKR/USDT pair might soar to $1,200.

Quite the opposite, if the value turns down from $1,080, it can recommend that bears proceed to promote on rallies. The pair may then droop to the 20-day EMA. A break beneath this stage will recommend that the bears try a comeback.

The 4-hour chart exhibits that the bulls have pushed the value above the resistance line, indicating that the short-term correction could also be over. The worth might dip to the resistance line, which is a crucial stage to control.

A robust rebound off this stage will recommend that the bulls have flipped the resistance line into assist. That can enhance the potential for a break above $1,080.

This constructive view may invalidate within the close to time period if the value plummets beneath the shifting averages. That would sink the pair to $831.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.

This text is for basic info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.